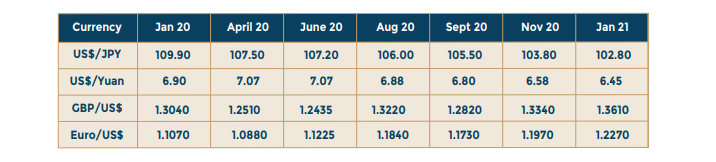

The slide of the US Dollar against all the currency majors continued to be the event that is most talked about in currency markets. There is no single major currency against which the Dollar has held well. This is despite any number of regional issues which have been there. This gives rise to the inference that there may be significant asset movements from the US Dollar to other currencies. Economies like India continue to receive substantial amounts by way of investments into equities by overseas investors. There is an increasing preference for emerging markets assets as evidenced by the renewed inflows. The recovery in Yuan has been more dramatic, after it dipped to 7.10 around June-July, it has moved up to 6.45. Yuan has been supported by the quick recovery in the Chinese economy with all the major macro variables indicating a rebound in the major segments of the economy. It is likely that Yuan may move up further as the economy continues to do well. Much would depend on the future direction of US policies too which will define the relations between these two big economies. The less noisy it becomes the better it is for China and also for the rest of the world. There is more or less unanimity that the US may not follow policies by which there would be serious disruptions to trade and the economy in future. The direction of US interest rates would also be material in this context. The likely rise in inflation over time may trigger changes in policy stance by the Fed which may in turn bring about some currency re alignments too. But this is a bit far from the present. The rise in oil prices should actually weaken the currencies which are over dependent on this commodity. The Indian Rupee has been broadly in the range of Rs.73 to Rs.73.50 the last two months. Despite the huge inflows which India’s equity markets witnessed, the currency has not strengthened against the US Dollar but remained stable mainly due to the RBI buying surplus dollars from the markets.