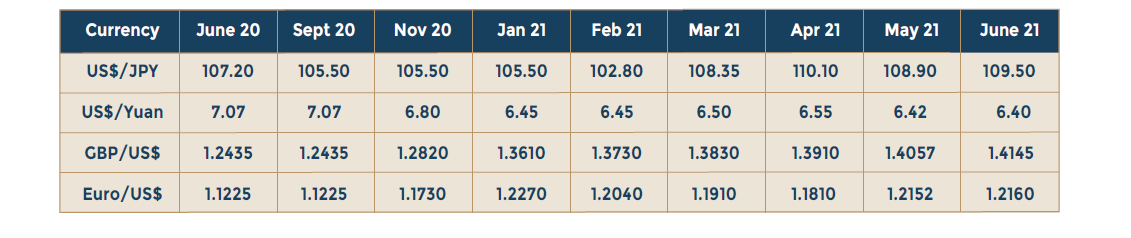

The US Dollar remained range-bound against major currencies, as it came out of a stark weakening phase, though the unit remained weak against the Euro and the Pound Sterling. The Euro and the Yuan gained over the last couple of months against the Dollar, to the extent to 3 % to 4 %. The likelihood of higher inflation and arise in US interest rates are the two factors that may decide the course of the Dollar. This view has been further reaffirmed by the statements from people in the government. The US Treasury Secretary, Janel Yellen said that higher interest rates may be good for the economy and the Fed. She also supported the US$ 400 billion spends by the government over the next one year as good and may not be too big to trigger run- away inflation. Given the fact that the US recovery has gathered pace, the demand for dollars, and therefore, the price of dollars may make gains in the coming weeks. The US jobs report has not been perceived as good at 559,00 as against the expectations of 671,000. Job growth is good but the expectations are even higher. Further improvements in job growth would indicate the intensity of the pace at which the economy is recovering. Also, there is recovery in Europe too, which may lead some investors into non-dollar denominated assets. Since the month of April, the Yuan has appreciated by 10 % and had touched 6.36 against the US Dollar. The central bank instructed commercial banks to hold more reserves in foreign currency with the central bank to prevent sales of dollar against the local currency. This is the first time in the recent past when the central bank intervened to stop the appreciation of the Yuan after moving into a more flexible system of currency management about two years back. Brazil and Russia have already taken rate action in anticipation of threats to the price level, and this may be the case with many emerging market economies too. Higher inflationary expectations and higher rates may not be palatable to many of these economies which are already under siege from a second wave of the pandemic and undecided foreign investors