The uncertain trajectory: Three months back as we had gone into the shutdown it was very clear that the trajectory of

both growth and inflation would be uncertain. This has found expression in the statements from the RBI too on more

than one occasion. This uncertainty is due to two factors, one, that due to the lockdown and lower production and

employment demand would be slower and therefore, inflation. Any lockdown destroys demand and annihilates the

flames of growth. Second, due to the peculiar conditions, estimates were going to be difficult. This was precisely the

reason why we did not have the headline inflation numbers in the last two months and got only the food inflation

numbers instead.

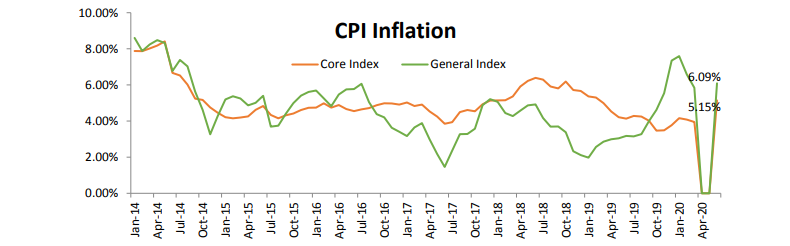

The CPI number for June is at 6.09%, a shade above the RBI ceiling but not too high for any concern. The core inflation is at 5.15%.

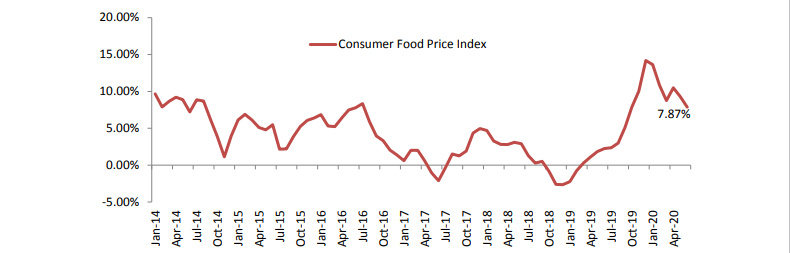

Pent up demand and excessive buying: The food inflation numbers were high in the last three months, but the latest number is lower than that of the last month. Food inflation number for June is at 7.9% as against 9.3% for May and 10.5% for April. It was expected that the food inflation numbers could be tricky. The moderation in food prices mainly due to fall in the prices of vegetables, meat and fish does not offer any significant ground for a sustained fall in inflation. There was too much of pent up demand due to the closure and dependence on only absolute essentials. This demand was to show up in a furious way once the lockdown was relaxed. Probably we are seeing that gradually playing out now. But we should not read much into this that retail demand is picking up and so all is well. In many economies the pandemic and the lockdown brought about a situation of excessive buying and emptying out of the shelves in the stores, which was seen as a big positive. But the reasons for this surge were different.

Uptick in rural incomes and rural demand: In the domestic inflation context there are more vital factors to be

reckoned with. We have seen a migration of population into rural areas. This migration brought with it several allied

problems. The steps taken by the government included supply of free food grains to those affected, enhanced

allocation of close to Rs.1.50 Lakh Crs to rural employment programs including MNREGA, and we saw the registration

under these schemes swelling to the extent of the displacement of migrant labourers. The fruition of these schemes

gradually through their reach is likely to enhance rural demand. This will give a fillip to the price level as well.

It may also be added here that the monsoon season has been generous enough to provide the more fundamental

buoyancy to the rural economy through the bounty of good crops after the rains. This augurs well for the rural

economy. This is critical for the economy at this juncture when we are battling many enemies, visible and invisible. A

little bit of inflation is good for the economy.

The official band and the seasonalities: As it stands today, the breach of the upper ceiling of the inflation band fixed by the RBI is very negligible. Therefore, this need not worry the policy makers. What is a higher priority is the need to lift the economy from the distressful economic conditions revealed through lower growth rates and contraction. In a contractionary phase, the central bank will have to overlook the concerns of price level in the immediate term and organize its efforts for growth and expansion. Therefore, such deviations in the price level may not take out of the policy its growth-orientation. There is yet another factor that we need to be aware of – there is a marked seasonality in the prices of fruits and vegetables. As we move through summer prices of fruits and vegetables accelerate and they tend to moderate as we get fresh crop of fruits and vegetables after the first monsoon. Therefore, we are justified in expecting a moderation in food prices over the next two or three months.

Reading it with WPI: The CPI number read along with the WPI number offers some insights. The WPI declined by 1.81% in June, compared to a 3.21% fall in the month before. Food inflation rose across all major items including milk, meat, cereals, pulses, egg, fish etc. But one thing that is gradually emerging if the urban-rural divergence in the

inflation trends. But it is too early to make a well- informed inference.

Growth comes with inflation: The inflationary pressures are likely to stay but it may not affect the course of the

the accommodative policy followed by the RBI as the current numbers indicate a mile deviation from the band. Of course, if the price pressures become formidable then it may slow down the forward acceleration of the policy initiatives. Something which no central bank would tolerate for a long time is severe asset price inflation. We need to understand the price level developments in conjunction with the speed of pick -up in growth and employment, to get a more holistic view of what is good and what is not. The veil of inflation may not be able to pale the accommodative stance.