The Fed has announced a much-expected pause in the interest rate hikes cycle. The pause, or a “skip” as some are calling it, was anticipated after the recently released inflation numbers. The consumer price inflation was reported at 4% for the month of May 2023, the lowest since March 2021. The RBI too in two successive polices decided to pause the rate action. A pause is just a bend in the river.

Way back in 2015, there was a section on the importance of central bank policy communication in one of the IMF papers. It looks like it has become more important today. More than the policy announcement or its contents, the tone of the central bank has assumed greater significance. The RBI governor was quite emphatic that the market should not read into the pause as an abandonment of the tight money policy, and that liquidity rationalization would continue, and furthermore, a rate hike cannot be ruled out if upcoming data warrants the same. The Fed has been more vocal about this potential for change. Therefore, the communication of the policy and its underlying tone has assumed greater significance today.

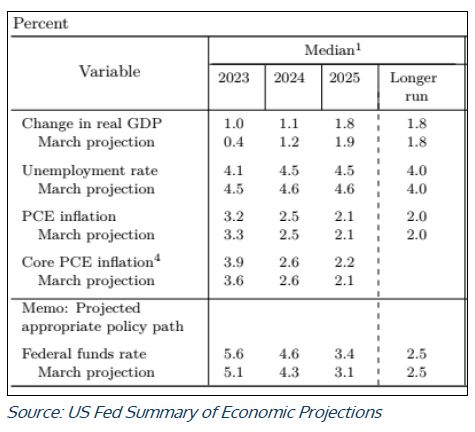

The dovish action of a pause has been accompanied by hawkish projections. The projections for GDP, Core inflation and Federal funds rate have all been revised upwards for 2023. The median forecast for fed rate has been placed at 5.6% as compared to 5.1% earlier. Thus, there could be two rate hikes this year itself though the current decision is a pause. The indications of impending rate hikes have led to short term rates moving higher, but the longer end has remained largely stable.

The observed behaviour of central banks is that the pace of action is higher when it comes to a hike in rates, and much slower when it comes to a cut in the base rates. All said and done, the probability of a rate hike after a pause is quite slim, as the hike after a pause is “the most unkindest cut of all”. But it will be data driven.

There is sluggishness in growth across all major economies on both sides of the Atlantic. China too is no exception. The tooth of inflation is more blunt with significant moderation in retail inflation with the last number for India at 4.30% and 4.00% for the US. The housing sector remains a potent danger for the US, as much as fuel and food for both India and the US. Fuel prices are a slave to two masters, the US Dollar and the OPEC+. The US Dollar gradually weakening with the tightening coming to a near halt, commodity prices including oil and gold could gain as they are quoted in US Dollars. This may have an impact on oil prices. Whenever, oil prices shift to the lower ranges, it was combatted by OPEC + with an output cut. This is going to continue unless the first factor takes over completely. The impact of climatic conditions on crops and their output is also keenly watched for their price effect. In the light of these realities price rise in essentials cannot be ruled out. RBI has put the average CPI for FY24 at 5.10% which is far above the median inflation target.

With a mild recession already unfolding, the central banks have hit on an optimum trade-off between the requirements of price stability and growth at the current levels where the need for growth is gradually getting the upper hand. Asset markets, both equity and fixed income tend to gain from lower interest rates. Fixed income markets will start benefitting from the current outlook relatively faster, while equities will gain immensely from a longer-term perspective. The short end of the curve will see systematic decline in rates, while long end may take more time due to the overwhelming supply factor at the long end from the primary. How the RBI is going to resolve the future money market shortages will hold the key to a more sustainable improvement in the market yields.

The pause is just a bend in the river. The river flows its course unmindful of what is happening on the shores.