What does the circular say?

The circular states that, “In order to diversify the underlying investments of Multi Cap Funds across the large, mid and small cap companies and be true to label, it has been decided to partially modify the scheme characteristics of Multi Cap Fund.”Until now the funds under Multi Cap category were to free to allocate the portfolio in stocks across the market cap spectrum without any restrictions. The new circular mandates these funds to have at least 25% allocation each to Large, Mid and Small Cap companies; in effect bringing 75% of the allocation under statutory guidelines. With regards to the timeline for the compliance of this mandate, the circular states that, “All the existing Multi Cap Funds shall ensure compliance with the above provisions within one month from the date of publishing the next list of stocks by AMFI, i.e. January 2021.”

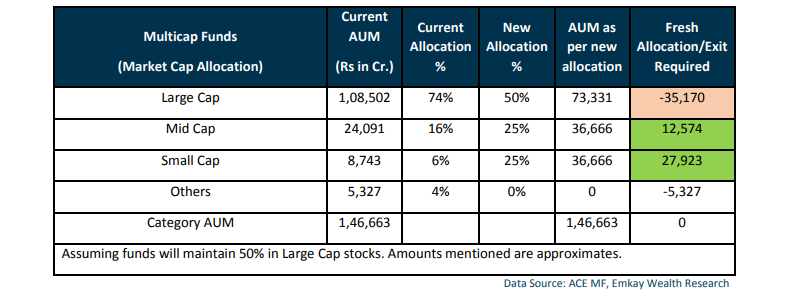

The portfolio adjustments required in Multi Cap funds

As highlighted in the above table, Multi Cap funds at the current juncture maintain an investment bias in favour of large cap stocks. Over the period of next 3-4 months the funds in this category will have to realign their funds to ensure compliance with the new circular. The allocation to large cap stocks will have to be trimmed in favour of mid and small cap stocks.

The initial calculations suggest that allocation to large cap stocks will have to be reduced by Rs. 35K crores, in order to incorporate the mandated changes and increase the exposure to mid and small cap stocks and bring it to minimum threshold. The average allocation to large cap, mid cap and small cap stocks currently stands at 74%, 16% and 6% respectively.

View:

The new SEBI regulation with respect to allocation is to be achieved by Jan 21, so there is three months’ time for the

changes to be effected in the portfolio. Given the time at hand for the fund managers to comply with the new circulars, the changes should be executed efficiently without any disruptions. Bhavesh Sanghvi, CEO, Emkay Wealth, is of the view that all funds may not effect the changes in the same way but may approach it differently. Some schemes may even consider changing the scheme categorization. If the funds intend to maintain the current allocation or the flexibility offered by other categories to maintain allocation in stocks across market caps, then change in product categorization may be seen. Fund houses have multiple options available to them like converting the existing multi cap fund into a flexicap fund or a thematic fund, or even completely changing the complexion of the fund. The impact cost of moving from large caps to small caps will be very high and no fund manager may like to be in such a situation, in the interest of unit holders and the fund’s long term performance.

Read more in our latest Navigator issue