Focused Equity Fund – An open-ended equity scheme predominantly investing in equity and equity related instruments. These schemes are mandated to invest in maximum 30 stocks and mention where the scheme intends to focus, viz., multi-cap, large-cap, mid-cap, small-cap.

Invesco India Focused 20 Equity Fund

Fund Details:

Fund Manager – Mr Taher Badshah; he has 26 years of experience. In his previous assignments, he has been associated with Motilal Oswal Asset Management, Kotak Mahindra Investment Advisors, ICICI Pru Asset Management and Alliance Capital Asset Management.

Exit Load – NIL for 10% of investments and 1% for remaining investments on or before 1 year,

Nil after 1 year

Benchmark – S&P BSE 500 TRI

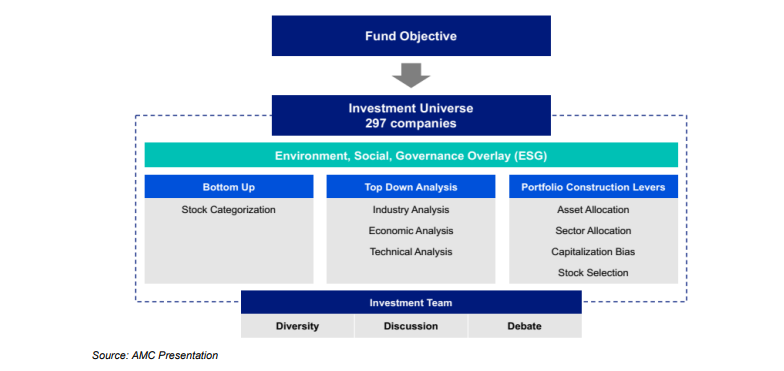

Investment Framework – The fund will invest in up to 20 stocks. It will have a multi cap portfolio

with the flexibility to move across market cap bands and will be a blend of growth and value stocks.

The stock selection will be guided by the fund house’s investment philosophy and proprietary stock

categorization framework. The fund will adopt a fully invested approach (~95% invested). The

allocation to large caps, mid-caps and small caps will be in the range of 50%-70%, 30%-50% and

0%-20% respectively.

Investment Process:

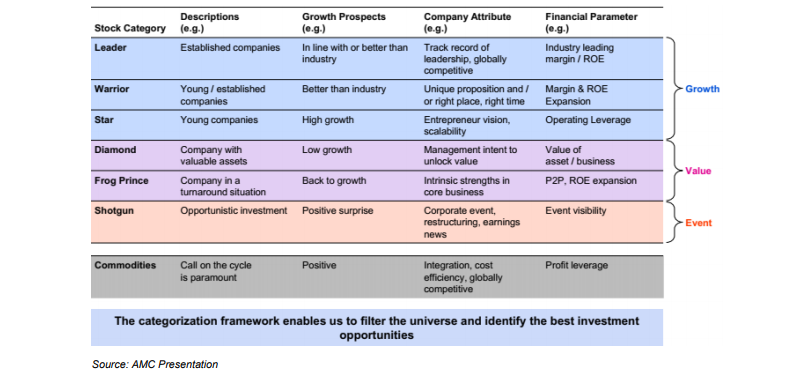

Stock Categorization Framework:

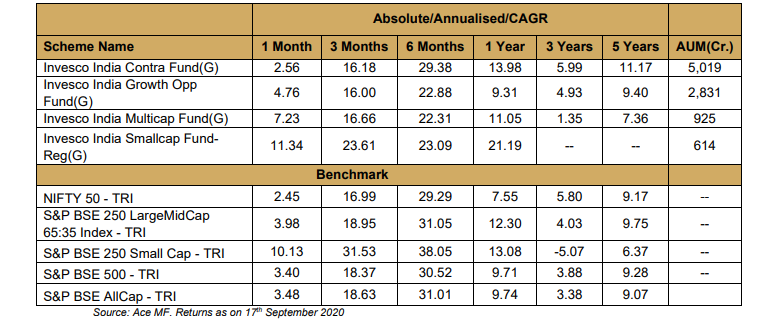

Performance of other funds managed by Mr Taher Badshah: