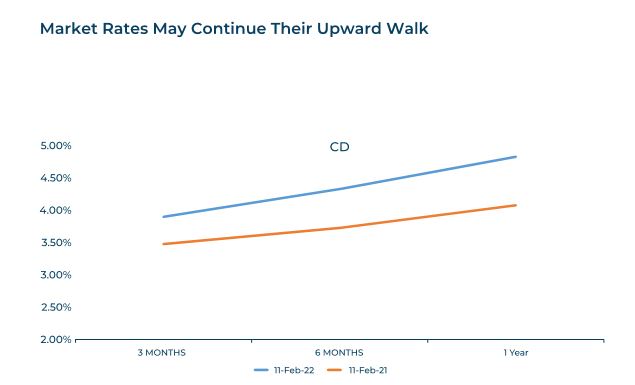

While the budget with its massive borrowing program, and a long-drawn-out fiscal glide path, was not entirely to the liking of the fixed income market. These were obvious reasons why the market rates went up, as expected by the market participants. Immediately after the budget the rates moved up and the benchmark ten year touched 6.90 %. But the monetary policy announcement from the RBI came as a great relief as the central bank reiterated its commitment to follow an accommodative stance to ensure that growth was sustainable. This was read into as a signal that rates may not be hiked by the RBI anytime soon. To that extent it is good for the markets.

But the reality is that market rates have already moved up, and therefore, it does not really matter whether RBI hikes the repo rate or not. The RBI may be following the markets if at all it hikes the base rates. The justification for the accommodative stance came from the vulnerability that is being created by both exogenous and endogenous factors, and the impact of the pandemic on certain sectors is still enduring and it calls for redemptive action. Apart from this, the central bank also stated that inflation was well within the threshold set by the RBI, and the average inflation is likely to gravitate towards the 4.50 % mark. The RBI believes that inflation may peak out soon, and then it may moderate. But the risks are more or less balanced and a surge in oil prices could lead to price pressures.

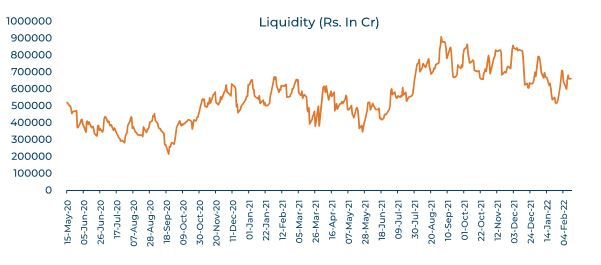

RBI has not mentioned anything about the government borrowing program of the central government and the state governments. It could be because it is something that is coming up in the next financial year and could be addressed later. How do we evaluate the situation under these circumstances? The liquidity normalization process is coming to a close, and it is the rate action that is more important in the coming days. The rate action may also be calibrated in such a way as to ensure that the primary issues go through smoothly. As you may be aware, the auctions in the current financial year were supported by liquidity actions from the RBI especially the GSAPs. In some form or the other RBI may have to support government securities issues in the coming year too. Something that could be of help in these circumstances is, a better than expected tax collection and proceeds from disinvestment. Any improvement in tax collections will reduce the excessive reliance on market borrowings, and thereby will diminish the pressure on the markets.

What needs to be kept in mind is the fact that the lowest rates in fixed income is behind us, and the economy is passing through a period of rising rates. There may be interludes of stable or range bound markets too. Bond yields have moved up in all the major global markets, with the US Ten Year Treasury yield touching 2 %. The suitable approach to investments will vary from investor to investor, but the basic approach should be one of sticking to relatively short -term portfolios and products, at the very short end of the curve. At the same time, corporate bonds, and papers with acceptable credit ratings, available at attractive yields, and to be held to maturity, may be invested into for yield enhancement.