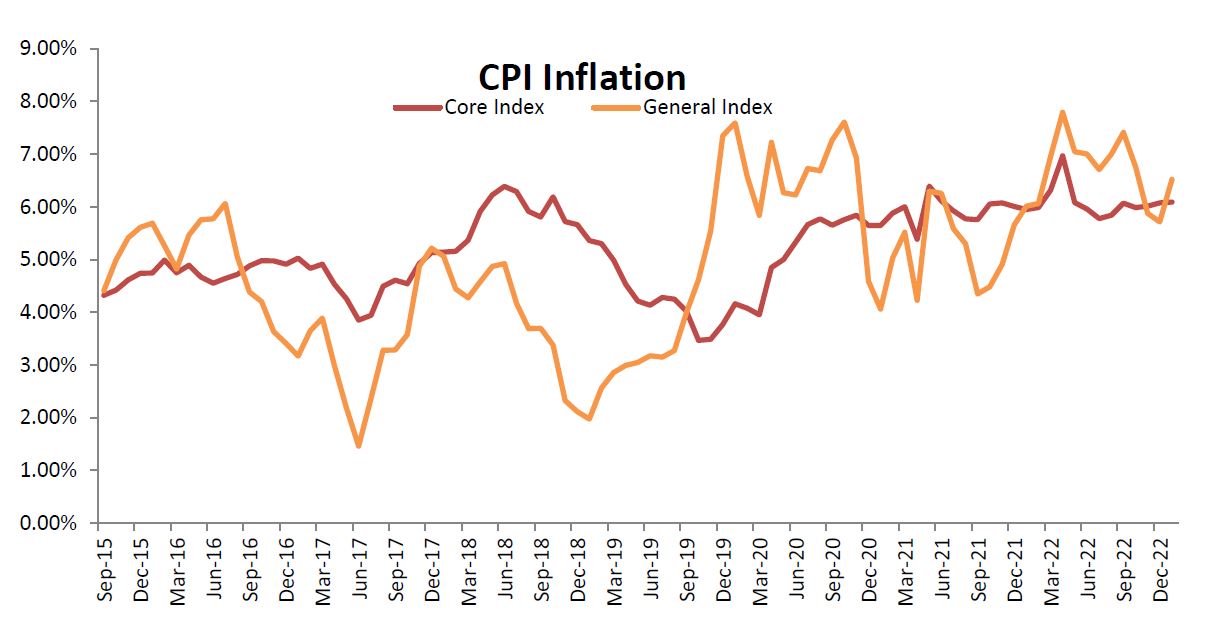

The CPI based inflation surged for the month of Feb’23 remained largely stable at 6.44% as compared to levels reported for the preceding month i.e., 6.52%. For two consecutive months, the headline inflation numbers have now remained outside the RBI’s target range. The consumer food price index-based inflation as well as core inflation eased marginally during Feb’23.

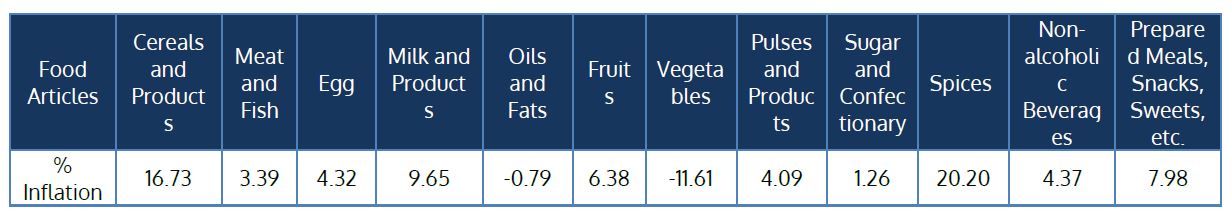

The Consumer Food Price (CFP) inflation for the month of Feb’23 was reported at 5.95% as compared to 6% for the preceding month. The marginal easing in food inflation is mostly on the back of fall in prices of vegetables. The food inflation lost some momentum as was visible from MoM sequential numbers. While vegetables and edible oil prices eased the inflation has remained strong for cereals, milk and spices. continued to ease whereas cereals, egg and spices witnessed inflationary pressures. The food prices continue to be the biggest risk to headline numbers given the early onset of summer and the resultant heat wave, and the risks of India experiencing El Nino effect this year. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 8.79%, 9.90%, 4.83% and 6.12% respectively.

Core Inflation

Core inflation remains sticky, with no signs of inflationary pressures waning over the near term. The core inflation continues to remain above the 6% mark. The easing of inflation for Clothing and Footwear supported the marginal easing in core inflation. Over the near term the core inflation is expected to remain elevated,

given the resilient demand for services. The high interest is expected to induce some slowdown in the economic growth, but it would have little impact on services demand as it is least influenced by interest rates.

Outlook

With the headline numbers staying outside the RBI’s target range for two consecutive months the central bank would be expected to maintain its hawkish stance. The street expectations, until now, were aligned towards repo rate at 6.5%, which would be the temporary peak as RBI takes a pause and gauges the effect of the

tightening executed till now. The latest data may lead to RBI hiking the policy rate one more time to rein-in inflationary pressures.

The developing situation in the US with regards to its banking system and the Fed’s response to it has the potential to modify the expected trajectory of policy rates domestically. If the risks of a contagion affecting the broader economy and leading to a recession are on the rise, then US Fed may be forced to adopt a growth

supporting stance sooner than earlier anticipated. The RBI may adopt a similar stance to safeguard growth. We believe at the current juncture the risks of a contagion are limited and the RBI may effect one more hike before it takes a pause.