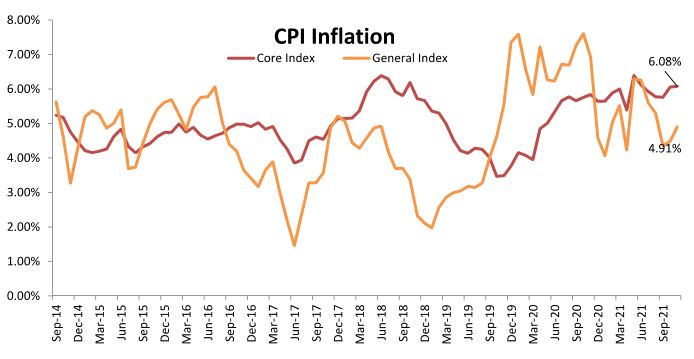

The CPI based inflation hardened for the month of Nov’21, second consecutive month in a row, as food inflation ticked higher. The headline inflation for the month of Nov’21 came in at 4.91% as compared to 4.48% in the preceding month and 6.93% during the year ago period. The core inflation remained largely stable and came in at 6.08% for the month of Nov’21 as compared to 6.06% in the preceding month.

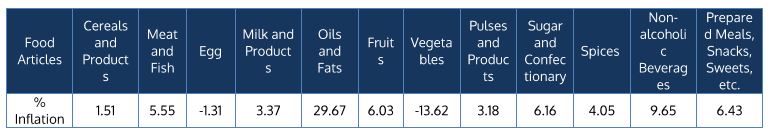

The Consumer Food Price (CFP) inflation moved higher from 0.85% reported in the month of Oct’21 to 1.87% for the month of Nov’21. The CFP index based inflation hardened as the inflation in the subcomponents remained sticky and the benefits of a high base waned and will continue to do so over the coming months. The YoY inflation numbers reflected the base effect but the immediate impact was captured in the sequential movement. The key components within the food basket that have contributed to inflation on a YoY basis are oil & fats and non-alcoholic beverages. The prices of pan, tobacco and intoxicants component eased marginally with the inflation at 4.05% in Nov’21. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 7.94%, 13.35%, 3.66% and 6.75% respectively.

Fuel Prices: Brent fell to US$ 75 levels in the last couple of weeks, close on the heels of the news about the new restrictions that are coming in, on travel and movement due to the new variant of the virus. This may put some pressure on the otherwise growing demand for fuel and the buoyant prices. All eyes are on large economies like India and China, where the government actions are keenly watched. Some of the analysts still maintain that a faster and sustained pick up in India and China, and a complete reversal of the pandemic related controls, could be the harbinger of higher oil prices next year. In this context, the extent of the spread of the current strain of the virus, assumes greater importance from a medium-term perspective.

Core Inflation: The core inflation remained stable in the month of Nov’21. The core inflation came in at 6.08% for the month of Nov’21 as compared to 6.06% seen in the preceding month. The Pan, Tobacco and Intoxicants inflation has remained subdued for the past few months on the back of a positive base effect. The impact of improving discretionary spends is visible in clothing & footwear and may impact the intoxicants component going ahead. The Miscellaneous component, indicator of price pressures in services industry, too remained largely stable. As the fuel prices eased post the cut in excise duty, the transport and communication sub- component within Miscellaneous saw some easing – in line with the easing witnessed in Fuel and Light component.

Outlook: As was discussed in the previous issue of FinSights covering CPI inflation, that the adverse base effect may have an impact on the headline numbers, the waning base effect in food inflation is visible now. The seasonal easing of vegetable prices during the winter season can have a dampening effect and may be supportive in neutralising the impact of base effect. While fuel inflation continued to be the top contributor to the headline numbers, the easing of international crude prices coupled with the cut in excise duty helped in slowing the momentum of price rise. Even as the fuel prices have eased marginally the risks remain on the upside as demand normalises to pre-covid levels. The risks to CPI based also emanated from the wedge with regards to the WPI inflation. The improving demand may also improve the manufacturers pricing power.

The rising inflationary risks and expectations did not have any impact on the RBI monetary policy stance and the same may continue to be the case for an extended period of time as the central bank remains in growth supportive mode. The policy is geared towards initially normalising the systemic liquidity situation which may in turn nudge the short end yields higher, without tinkering with the policy rates.