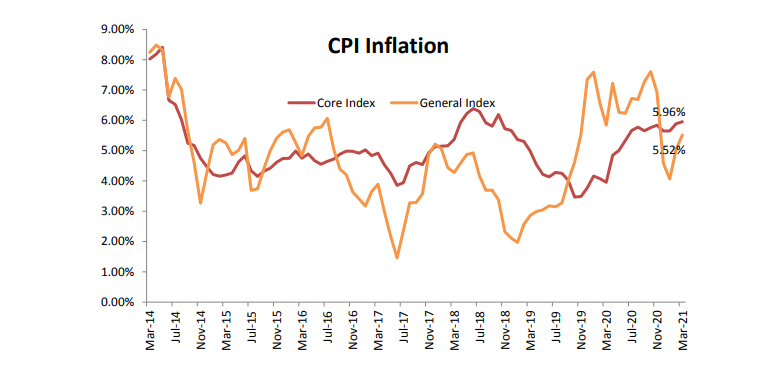

Consumer Price Index (CPI)

The CPI based inflation, continued to inch upwards owing to broad based inflationary pressures; the food and fuel as well as core inflation remained firm in the month of Mar’21. The headline CPI inflation was reported at 5.52% for the month of Mar’21 as compared to 5.03% for the preceding month and 5.84% during the year ago period. The waning effect of the first wave of pandemic and resultant uptick in demand in the second half of FY21 led to a lockstep movement in core and food inflation. The broad-based rise in inflation numbers across the components is indicative of an improving demand scenario but the recent emergence of the second wave of the ongoing pandemic may have a dampening effect on inflation going ahead.

The Consumer Food Price (CFP) Index based inflation, after touching a low of 1.96% in the month of Jan’21 has maintained an upward bias and was reported at 4.94% for the month of Mar’21. The CFP inflation was reported at 4.94% for the month of Mar’21 as compared to 3.87% for the preceding month. While the inflation for Cereals remains contained and the Vegetables component has cooled-off, the firmness in prices of Meat & Fish, Egg, Oils & Fats, and Pulses continues to make the food basket dearer. Apart from food inflation, the other components such as Fuel, Housing and Miscellaneous too have reported gradually hardening inflation over the recent past. The risk of inflation has moved to a higher side, from the context of rising input cost pressures.

Fuel Prices: Oil prices have been range-bound without any major surge in prices as expected earlier. This is due to the fact that the OPEC + had decided that they may increase production gradually by about 2 million barrels per day. The prices have found a base at the US$ 60-63 levels. What is likely to prevent the prices from rising is the rapid resurgence of the pandemic in the recent weeks in most parts of Europe and also in large importers of oil like India. The expectation is that oil imports by some of the affected countries will fall again as it happened in the first wave of the pandemic and could lead to destruction of demand. Having said that, the stimulus measures deployed by the US may create some support for oil prices.

Core Inflation: The core inflation has gradually hardened over the course of FY21, and the trend continued for the last month of the fiscal year as well. The core inflation hardened to 5.96% for the month of Mar’21, as compared to 5.88% in the preceding month. The pick-up in demand post the relaxation of lockdowns was the key factor influencing core inflation. The components such as Pan & Intoxicants and Clothing have witnessed sticky inflation over the recent past. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 6.88% in the month of Mar as compared to 6.82% in the preceding month. Within Miscellaneous component the pace of rise in inflation was the quickest in Transport & Communication, Health and Recreation.

Outlook: As discussed above, the upward movement in headline numbers is largely an effect of broad based rise in most of the sub-components rather than a single component. Even as there has been some sequential easing in prices of food basket, it may potentially exert pressure on headline numbers given the seasonal volatility in price of food articles. The Core inflation too continued its movement higher, as the economy gradually opened-up and demand improved. The rise in input cost pressures is another factor that increases the upside risk to inflation. The manufacturers’ survey captured through the PMI report too indicates that the input cost pressures continue to remain on the upside.

While the upside risks to headline numbers remain elevated due to the seasonal impact on food prices and the evolving positive outlook on demand sustenance, over the near-term inflationary pressures may remain subdued due to the resurgence of the pandemic. The localised lockdowns to contain the surge in pandemic and its effect on demand coupled with the base effect may keep the headline numbers in check.

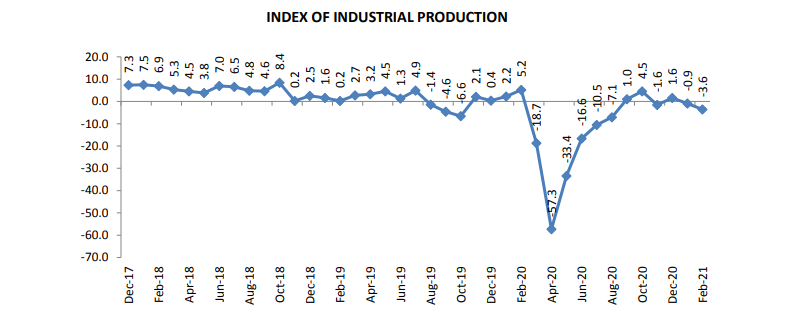

Index of Industrial Production

The industrial activity as measured by IIP remained in contractionary zone for the second consecutive month. The IIP growth for the month of Feb’21 was reported at -3.6% as compared to contraction of 0.9% in the preceding month and growth of 5.2% in the year ago period. The reversion into contractionary zone was mainly owing to weak manufacturing activity. The usebased classification indicated that the consumer demand improved marginally, the other components remained weak in the month of Feb’21.

Out of the three constituent sectors of IIP, two, Mining and Manufacturing, reported contraction in activity while Electricity reported growth. The Mining and Manufacturing growth contracted by 5.5% and 3.7% respectively for the month of Feb’21. The Manufacturing growth continues to be lackluster with only 6 out of the 23 constituent industries reporting growth for the month of Feb’21. The growth for Electricity sector was reported at 0.1%.

View: T e level of industrial activity is gradually improving but the high input cost inflation and the resurgence

in COVID-19 infections may have a bearing on growth numbers going ahead. The localized lockdowns to control the spread of the pandemic may negatively impact both demand as well as capacity utilization. The base effect would start turning beneficial from the month of Mar’21 as the comparable period during the previous year was marred by strict lockdowns. Over the near term the headline growth numbers may sway in line with base effect.