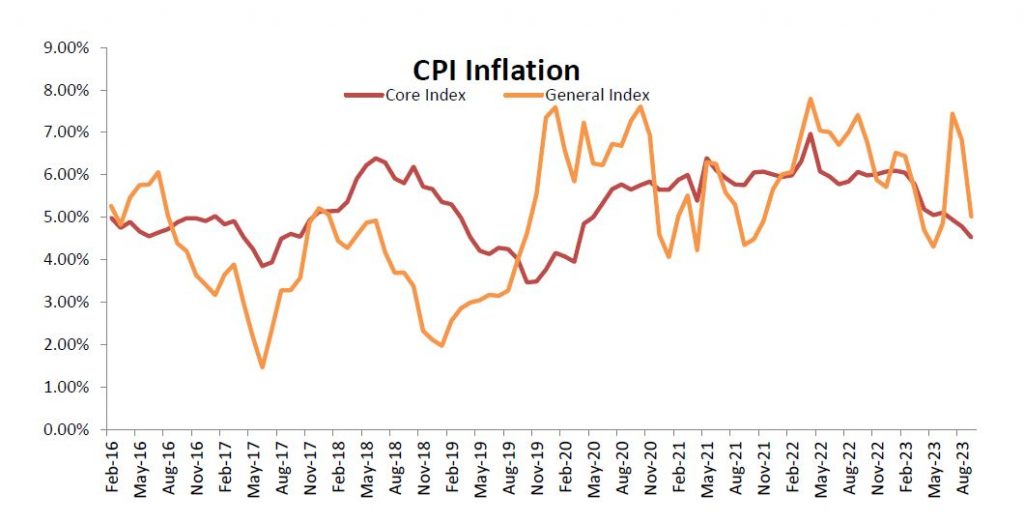

The CPI based inflation eased to 5.02% for the month of Sep’23 as compared to 6.83% in the preceding month and 7.41% during the year ago period. The easing in the prices of vegetables and a favourable base effect were the key factors that supported the easing of headline numbers and the same getting reported below the street estimates. The easing in fuel inflation too played a critical role. The core inflation too continued with its easing trend.

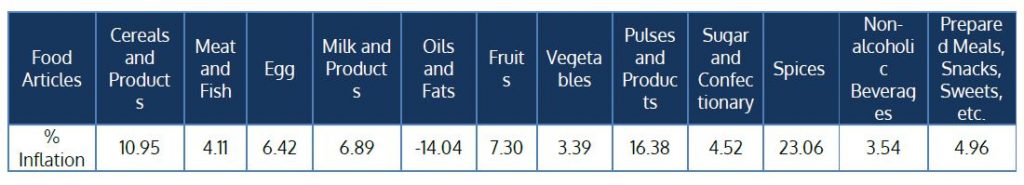

The Consumer Food Price (CFP) inflation for Sep’23 was reported at 6.56% as compared to 9.94% for the preceding month. The sharp easing witnessed in the prices of the food basket was on the back of vegetables prices reversing from the spike seen in the month of July. With the culmination of the monsoon, the seasonal vagaries are expected to recede and so is the volatility in the prices of vegetables. The easing of pressure emanating from the food basket is also evident from the sequential, i.e., MoM, fall in the CFP index. The components of the food basket that are reporting elevated and sticky inflation are cereals, pulses and spices. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 4.61%, -0.11%, 3.95% and 4.77% respectively.

Core Inflation

The core inflation (ex. food and fuel) maintained the trend of the preceding two months and eased further in the previous month. The core inflation came in at 4.53% for Sep’23 as compared to 4.79% in the preceding month. The core inflation appears to have been stabilised below the 6% mark. The clothing and footwear inflation continued to ease; housing prices too reported fall in inflationary pressures; factors constituting miscellaneous inflation too reported loss in momentum.

Outlook

The movement in the CPI based inflation, over the recent past, has largely been a function of volatility in vegetable prices. Even as the risk of further spikes in vegetable prices has ebbed, the focus would be on the trend in the prices of non-perishables. The RBI in its last policy statement had expressed concerns with regards to lower land area sown for pulses as compared to year ago level.

The second key risk to inflation numbers is the movement in oil prices. Towards the end of Sept 2023 the oil prices had spiked to close to $98 per barrel, on the back of supply side concerns, but has since corrected as the International Energy Agency (IEA) observed in its report that the spike in oil prices has led to demand destruction. The other factor that has supported the easing in oil prices is that there has been no disruption in supply due to the geopolitical situation in Middle East. Any escalation of the ongoing situation may have a bearing on supply; the Middle East region accounts for more than one-third of the world’s seaborne oil trade (source: IEA October 2023 report).