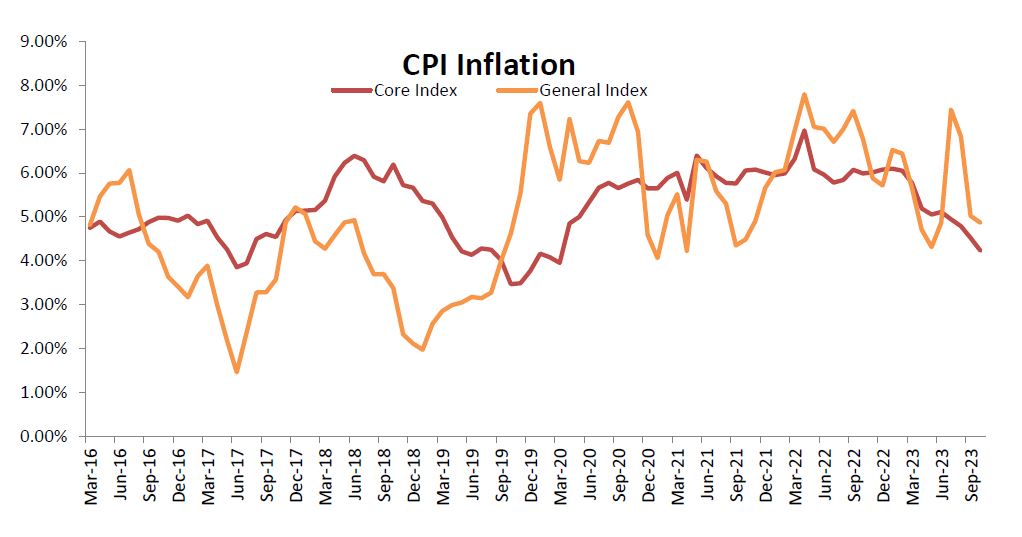

The CPI based inflation eased for the third consecutive month and was reported the 5% mark. The headline inflation for the month of Oct’23 came in at 4.87% as compared to 5.02% for the preceding month and 6.77% for the year ago period. A high base and continued easing in core inflation numbers were the key factors that influenced the softness in headline numbers.

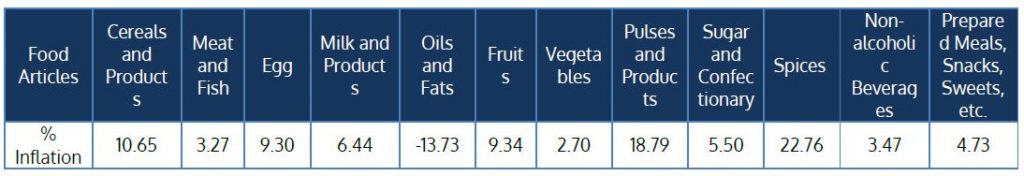

The Consumer Food Price (CFP) inflation for Oct’23 was reported at 6.61%; largely stable when compared to the preceding month’s numbers. Even as the YoY inflation remained stable for the food basket, sequentially (i.e. MoM) the index was up by 1.06%. The volatility in vegetable prices is having an outsized impact on the overall food inflation. The spike in tomato prices has normalised, but now price pressures are seen in onions. The components of the food basket that are reporting elevated and sticky inflation are cereals, pulses and spices. Food inflation may remain elevated and push the November numbers higher, as the base effect wanes. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 4.31%, -0.39%, 3.80% and 4.40% respectively.

Core Inflation

The core inflation (ex. food and fuel) maintained the trend of the preceding three months and eased further in the previous month. The core inflation came in at 4.23% for Oct’23 as compared to 4.52% in the preceding month. The core inflation appears to have been stabilised below the 6% mark. The clothing and footwear inflation continued to ease; housing prices too reported fall in inflationary pressures; factors constituting miscellaneous inflation too reported loss in momentum. The slide in core inflation may be indicative of weak demand scenario in the economy.

Outlook

The CPI based inflation numbers have been trending lower but that may not necessarily lead to RBI lowering its guard. The risks to inflation have not entirely abated, as has been witnessed from the movement in vegetable prices. Over the near term the trajectory of headline numbers is expected to be a function of the price pressures in the food basket. The movements in the more volatile category such as vegetables and the concerns regarding the lower kharif sowing area impacting crop prices, especially rice, may lead to headline inflation changing trend. As per RBI’s projections the CPI based inflation is expected to be 5.4% for FY24.