The GDP growth rate for Q1FY24 came in at 7.8% as compared to growth of 6.1% in the preceding quarter and 13.1% during the year ago period. The GDP growth rate was in line with street estimates. The strong performance of the services sector and robust government capex were the key factors contributing to the GDP growth.

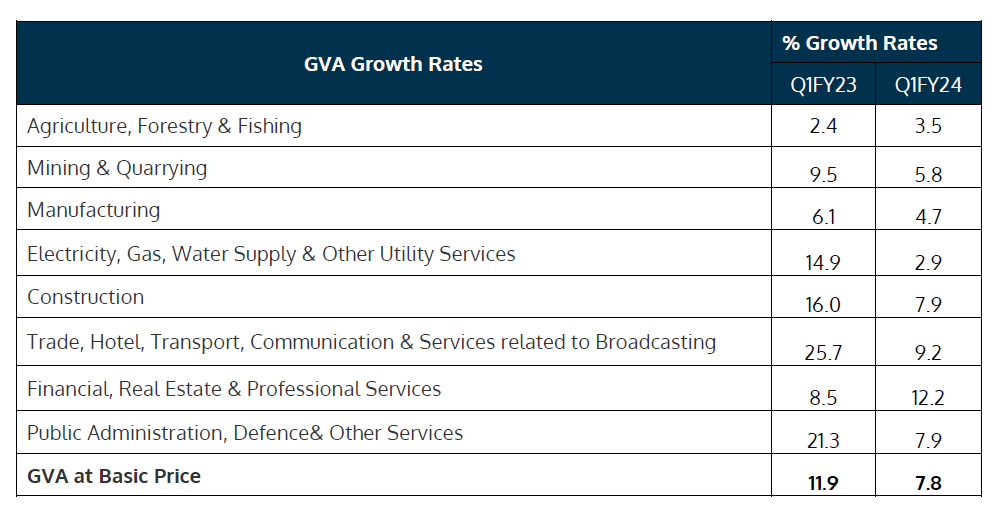

As per NSO data on the Gross Value Added (GVA), the growth rate for Q1 was 7.8% as compared to growth of 11.9% for Q1FY23; the preceding quarter growth rate was reported at 6.5%. Agriculture & Allied activities and Mining & Quarrying GVA growth showed a minor slowdown over the preceding quarter. The industrial sector was a drag on the growth with all the segments vis., mining, manufacturing, electricity and construction reporting subdued growth. The sluggishness in manufacturing segment came as a surprise and is indicative that private capex is yet to pick-up meaningfully.

The services sector continued to be the lead contributor to headline GDP numbers. The improvement in private consumption has largely translated into gains for the services sector. The growth in services sector was led by Financial, Real Estate and Professional Services segment, followed by Trade, Hotel and Transport. The government spending, as reflected from growth of Public Administration, Defence and Other services, too improved as compared to the previous quarter as government front ended the capital expenditure.

As per the use-based classification, the growth was mainly driven by private consumption and gross fixed capital formation. The private consumption, after recording sub-par growth during the second half of FY23, reported a healthy recovery in Q1FY24 with a growth rate of 6%; this bodes well for the demand outlook. The gross fixed capital formation continued to report healthy growth rate as the budgetary outlays have been capex driven. Since the pandemic, government expenditure has done the heavy lifting to support the growth.

Going ahead the growth is expected to be well supported by sustained buoyancy in private consumption and investment activity. The key risks are emanating from subdued exports demand, lagged effects of monetary policy tightening, geopolitical concerns and a weak monsoon. The weakness in world’s second biggest economy (China) too is expected to exert pressure on global growth. The above concerns may lead to gradual easing of growth rates during the year.

The RBI in its last monetary policy has projected FY24 growth to be 6.5%, with risks evenly balanced. Notwithstanding the risks discussed above, this figure seems to be an achievable target at the current juncture based on improvement in domestic demand and continued efforts by the government, both in terms of actual spending and creating a conducive regulatory environment. The joint efforts by the RBI and the government to contain inflation too gives a certain degree of confidence that further policy tightening may not be necessary and an optimal inflation-growth trade-off might be achieved.