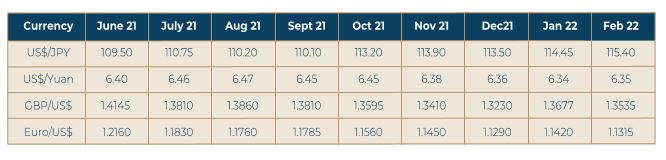

The trend is intact. The US Dollar is stronger. There is no reason to expect this to soften anytime given the several factors that lend strength to the US unit. The likely hike in the base rate by the Fed in a month or two, and the rising US yields have added strength to the currency. The impact of the hike in the base rate by BOE had a short-lived impact on the currency, and the ECB’s approach of wait and watch on the normalization process also helped the Dollar. Asset movements are paramount in the determination of currency levels in the medium to long- term. The Yuan has lost some ground but not substantial, and this could be due to the impact on trade in the immediate term resulting from the strict shutdowns in some of the covid affected provinces. There are also reports of a tie up between China and Russia for sale of fuel to the latter to protect each other’s interests in case of a prolonged confrontation with the West on the matter concerning Ukraine. The real estate related issues are far from over, and that may also be a factor to reckon with on the currency levels. The Rupee will edge lower with exits by overseas investors and the gradual rise in the current account deficit. It may also be pointed out that central bank selling of Dollars may be able to hold the exchange rate around the current levels but the need to finance oil imports with rising fuel prices in international markets offers yet another challenge.