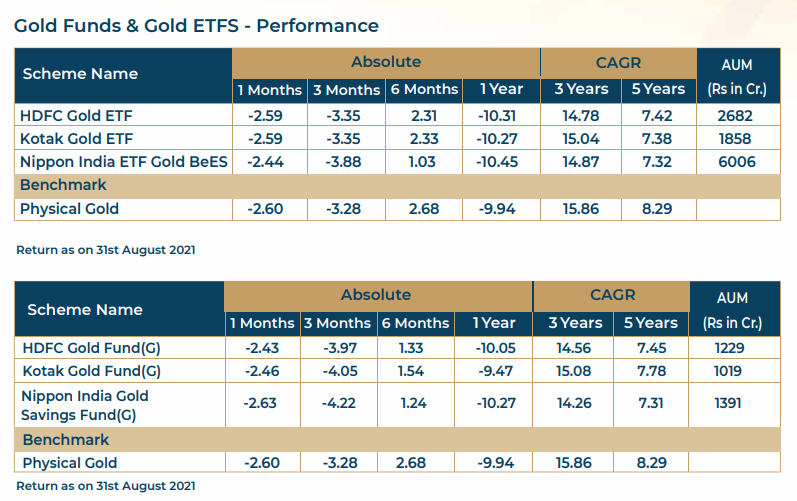

Gold has not moved at all in the last one or two months, and it may stay where it is and may move in very narrow trading ranges. There are no fresh triggers for the gold price to move up or down. Currently at 1790, gold faces tough resistance at 1830 and 1870, and the support is at 1760 and 1720. Gold ETFs saw outflows in August to the tune of US$ 1.30 billion, bulk of which was in the US based ETFs. This outflow was occasioned by the strength in the US Dollars witnessed as the speculations regarding Fed normalization gathered pace, and the third wave of the pandemic failed to be as strong as the second wave with vaccinations happening at a fast rate at all major international locations. This has ruled out the uncertainty factor which used to cloud the future expectations on economic growth. The only factor that could help gold gain some traction is the trajectory of inflation in the major global economies like the US, China, and India, and also the EU. Retail inflation has been moving up but it looks like it may not sustain at high levels for long time. It is fuel prices and weaker currencies that may be of some import as far as gold prices are concerned. With growth becoming sustainable and inflation under control, with retail inflation stable if not lower, the push that gold would have received from this may not endure for long. At best gold may be range-bound, and with any signs of US rates hardening gold may test lower levels.