The availability of data improved in the month of July, as the data was available from 95% and 92% of the urban and

rural centres respectively from the earmarked centres. The quality of numbers has thus improved and may find due

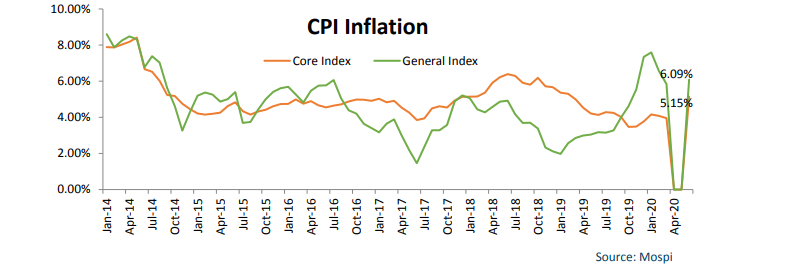

consideration from the policy makers. The headline CPI based inflation was reported at 6.93% for the month of July as compared to 6.23% in the month of June. As was witnessed in the month of June as well, the inflationary pressures were higher in the rural economy than the urban one. The CPI Rural inflation was reported at 7.04% as compared to 6.84% level for CPI Urban. The inflation numbers have been running above the RBI’s target range, 4% +/-2%, since the start of the current calendar year.

The lockdown conundrum: The lockdowns have been gradually withdrawn across the country since the last two

months. The normalisation of situation has led to gradual pick-up in demand both in urban as well as rural centres.

Even as the lockdowns are being relaxed, certain areas still face restrictions depending on the severity of the COVID

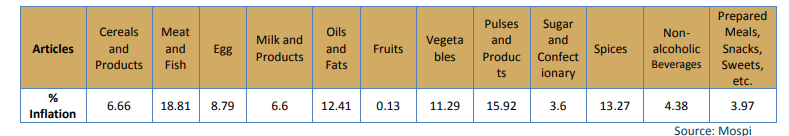

spread. The mismatch between demand uptick and supply disruptions owing to restrictions in free movement of goods are some of the factors stoking inflation. The heavy rainfall and flood like conditions in several parts of the country too has impacted the supply of perishables and visible from the sharp rise in prices of vegetables. The inflation rate for vegetables was reported at 11.29% for the month of July. Similar or higher inflationary pressures were also witnessed in the other commodities from the food basket such as Meat & Fish, Oils & Fats, Pulses and Spices.

Fuel Prices: Even as the international crude prices have remained range bound, the hike in duties domestically has

maintained an upward pressure on domestic prices. The fuel-based inflation was reported at 2.80% for the month of

July as compared to 0.5% in the preceding month. The second-round impact of high fuel inflation is also felt in other

commodities by way of increased transportation costs.

Core Inflation: The core inflation, ex food and fuel, too has reported an uptick over the last two months. The core

inflation for the month of July was reported at 5.87% as compared to 5.33% in the preceding month. The Pan, Tobacco and Toxicants has witnessed a sharp up move, the inflation getting reported at more than 12% for the month of July. The Miscellaneous component, the indicator of price pressures in services industry, too has reported an upward move in inflation. The inflation numbers for the said component were reported at 6.95% for the month of July. Within Miscellaneous component, heightened price pressures were seen in Transport & Communication and Personal care and Effects.

Outlook: The inflation numbers have hardened over the last few months on the back of rising price pressures on the

food basket. The inelastic demand coupled with supply disruptions was the key factor influencing the prices of food

articles. The seasonal impact on the supply of perishables too has negatively impacted the inflation numbers. As has

been communicated earlier as well, the headline inflation numbers are expected to remain elevated over the near

term, till the time food inflation gradually dissipates. The expectations as of now are pinned on a bumper kharif crop to cool down prices, but that would only be available post September. The second factor of importance is the rise in core inflation. If the core inflation continues to inch-up it may indicate towards sticky headline numbers, the risk of which is still low at the current juncture. The inflation numbers are not expected to remain elevated for an extended point of time, as inferred from the fact that RBI has noted in its latest policy that room for further easing is still available. The immediate impact of the rise in inflation may be that the execution of further policy easing could get pushed towards the end of the year.