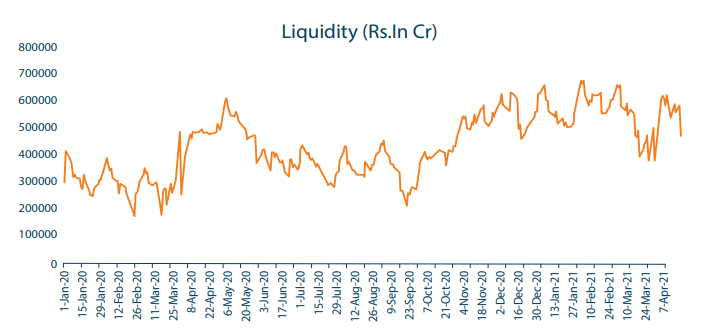

The fixed income market remained calm with a stable profile for most part of the last one month. The accommodative policy of the RBI has been instrumental in keeping the yields stable to lower. Yet another reason is the interbank liquidity which has been on an average upwards of Rs.5 Lakh Crs. The G-SAP 1 announced in the last monetary policy has already touched down on the turf with two tranches being introduced already. This has definitely helped soften the rates a bit, though the quantum is quite small compared to the size of the primary issues coming up week after week. The recent announcement by the RBI enhancing the financing support for specific segments like healthcare and small enterprises further reaffirms the fact that the central bank will not be averse to taking actions which are in the interest of the economy and that too in a timely manner. This is significant as the support is going to reach the beneficiaries through the banking system and the non-banking finance companies, with a time horizon of three years.

In the RBI’s assessment there are uncertainties caused by the second wave of the pandemic, and these uncertainties, depending upon how prolonged the second wave would be, may affect the macro variables adversely. These developments rule out any change in the RBI policy in the near future. Many of the GDP estimates have cut growth by 1.50% to 2 %, and this would certainly be a factor which will affect the trajectory of policy rates. Coming to issue of primary government debt, while the current secondary market purchases are barely sufficient to cover the entire issues it may be possible that the future secondary market purchases may be of a higher order. In that case the yields at the long end of the curve may enjoy some support for a longer period of time. The normalization process from the RBI, and the upward movement in yields would depend on a number of factors – the extent of the likely impact of the second wave of the pandemic on demand and production, the impact on economic growth and the revival of the same, improvements in the global economic scenario. Inflation levels look challenging as it is hovering around the 5.50 % level, very close to expectations. The high commodity prices, the higher oil prices, the weaker Rupee have all contributed to the higher price level. This may not get altered much, as the transmission is through the exchange rate. Also, the crop of grains from the last season is aplenty and this may have a favourable impact on food grain prices. One thing that may not get impacted favourably is the prices of pulses and protein rich foods, which have a longer crop cycle. If the second wave of the pandemic starts affecting the demand conditions, we may see some moderation in general price level but it will be rather transitory.

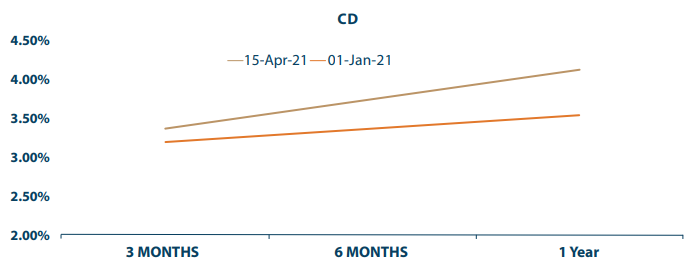

In fixed income, it is still the short end of the curve that is preferred. Even those who are invested into the short end may gradually move into the very short end over the next two or three months, to avoid any loss of value due to a gradual rise in rates, owing to normalization of liquidity and economic conditions, most likely over the next three to four months.