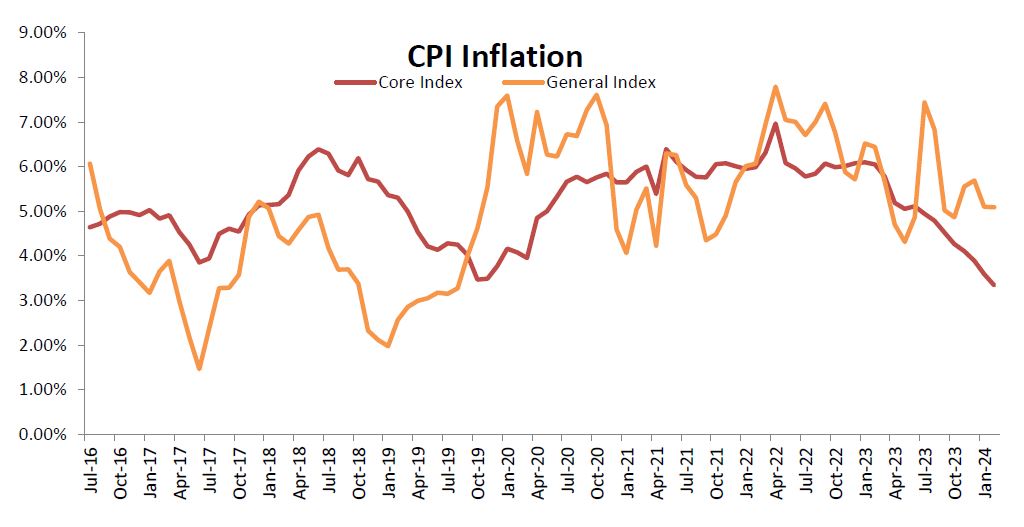

The CPI based inflation for the month of February 2024 remained largely unchanged at 5.09% as compared to the previous month. The CPI inflation during the year ago period was reported at 6.44%. While the headline number remained flattish, the underlying components reflected diverging trends; the food inflation inched higher, whereas core inflation continued with its easing trend.

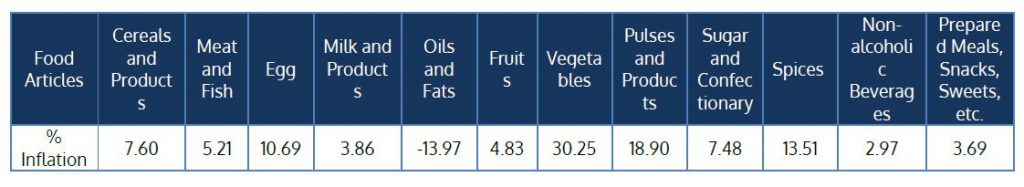

The Consumer Food Price (CFP) inflation for Feb’24 was reported at 8.66%; an uptick as compared to the inflation number of 8.30% of the preceding month. The sequential easing trend of the past two months was broken as the food inflation hardened on the MoM basis as well. Cereals, Milk and Meat and Fish were some of the food components that supported the sequential momentum. The YoY inflation numbers indicated stickiness in prices of certain components of the food basket such as Egg, Vegetables, Pulses and Spices. The weather related vagaries were expected to remain subdued, but have again come to the fore and may further impact food inflation prospectively. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 3.14%, -0.77%, 2.88% and 3.57% respectively.

Core Inflation

The core inflation (ex. food and fuel) maintained the trend and eased further in the previous month. The core inflation came in at 3.34% for Feb’24 as compared to 3.59% in the preceding month. The inflationary pressures have remained largely subdued both in manufacturing as well as services oriented industries. The percolation of interest rate hikes is visible in core inflation. At the current juncture, in a high interest rate environment, the core inflation is not expected to throw any negative surprises.

Outlook

The headline inflation numbers have stayed within the RBI’s target range but at the higher end, given the stickiness witnessed in food prices. The volatility in food prices have made RBI specifically vary of indicating any timeline for expected rate cuts; the first indication of the same would have been the change in the policy stance. At the current juncture, given the trend in food prices and robust projections of GDP growth, the RBI’s target for CPI inflation of 4% may require a status quo on rates for a longer duration. Even as the rate cuts may take some time, the market yields are expected to have a softening bias (especially at the longer end of the yield curve) given the lowered borrowing program and the inclusion of domestic sovereign papers in global bond indices related liquidity dynamics.

The domestic interest cycle is expected to be in sync with the global one. As with domestic inflation numbers, the inflation for US has also remained largely stable but the unemployment numbers deteriorated, and it again raised hopes of a rate cut. At the earliest, the rate cut expectations are pinned at the June 2024 FOMC meeting.