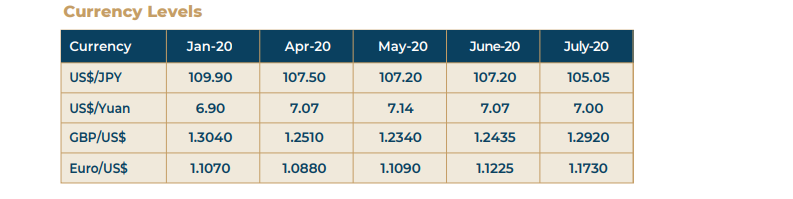

After a prolonged period of strength, the US Dollar lost some ground against all major currencies in the recent weeks, a phenomenon witnessed after a long time. The weakness was more marked against the Euro, Pound Sterling, and the Japanese Yen. While the pandemic worsens in the US with no relief seen in the near future from the raging epidemic, the level of uncertainties is raised to very high levels. This has started affecting the perception around US assets

However, a more fundamental factor is the soft money policy followed by the Fed and the aggressive easing of rates in the recent past. As the local rates come down, the currency yield is adversely affected, and this prompts investors to move into currencies with higher yield. In the run up to the US presidential elections which is barely three months from here, may also render the currency markets more volatile. It may also be added here that Euro and Yen currently enjoy the status of reserve currencies and they are quite stable without any internal or external influences at this juncture.

The Rupee displays some strength derived from factors like strong inflows through FDI, rise in forex reserves, and a current account surplus. While these factors have been favourable in the immediate term, it may be mentioned that the FDI inflows have been positive with reference to a limited number of companies or deals, and there has been a fall in both exports and imports due to the pandemic and the lockdown. Unless FII inflows too improve and a sustained pick up in trade, the domestic currency may not be able to sustain the strength it is displaying as of now.