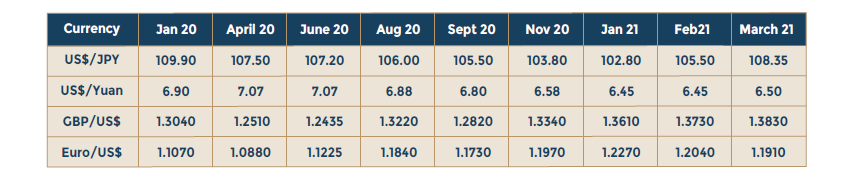

The US Dollar continued to maintain a stronger undertone against all the currency majors as is evident from the currency movements for more than a month now. One of the major factors that contributed to the Dollar strength is the sell off in the bond markets across many developed markets. The rise in bond yields have contributed to higher currency yield for the Dollar and this has helped the resurgence in Dollar prices. Chinese Yuan stays more or less where it was on account of good trade data. China had a trade surplus of US$ 103 billion in the first two months of the year, of which 50% is the trade surplus with the US. Chinese exports recovered strongly and in the first two months of 2021 exports rose by 60 %, and imports grew by 22 %. While this may be due to the obvious benefit of a lower base, the key indication is that there is good demand for products from China in the industrial and manufacturing sectors. Though there was some movement into emerging market assets in Korea, Taiwan etc. the last one month has witnessed outflows mainly on account of exits from the equity market. The pressure on emerging market currencies are likely to rise as the US economy retains its path towards a strong recovery and interest rates have started moving up. There have been no significant changes in the Euro and GBP, except that against Euro the Dollar appears to have an upper hand whereas GBP it seems to be missing especially after Brexit, though most analysts believe that the real consequences of Brexit on the UK will unfold only over the next couple of years, as businesses and investors prepare for either continuity or exit for their businesses which cater to the rest of Europe but based out of UK.