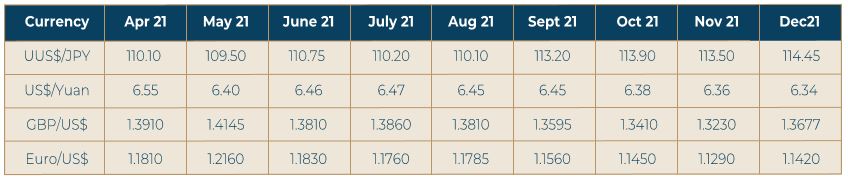

While the trend of US Dollar strength was intact against a number of global currencies, it received a temporary set- back against the Euro and Pound Sterling. The Bank of England hiked the base rate in its last meeting, and this has given a push to the positive perceptions about the UK economy. Not only that, the swiftness with which the pre-emptive hike was done ahead of the Fed and the ECB infused greater confidence in both investors and consumers that appropriate steps will be taken by BOE well ahead of time. This has lent some strength to the Pound Sterling. The ECB has taken a different position this time. It feels that a continuation of the accommodative stance may be required in the light of the fast spread of the new variant of the pandemic, and it has affected mainly European countries to a significant extent. The Yuan is holding well against the Dollar, but the impact of the shutdowns and the enduring weakness of the real estate sector are likely to affect the GDP growth in the current quarter as well as the coming one. Also, the retail sales in China for December has come as weaker than expected. The central bank slashed the lending rates recently in its efforts to support funding for the one-year time horizon. The fortunes of the Rupee has been closely intertwined with the equity market actions of the foreign investors, who have been net sellers in equity for many months now. But, on several occasions the central bank activity capped the fall in the Rupee. However, the worsening trade situation may put pressure on the currency in the coming three months, and a relatively weaker Rupee may be the order.