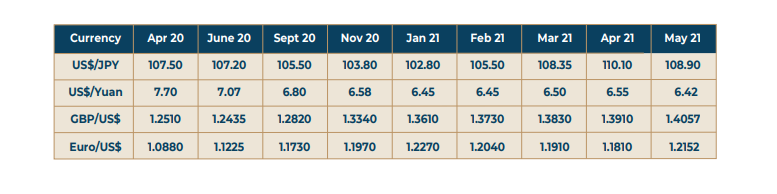

The US Dollar has given up much of the gains after it rose against all the majors in the last three months. The rise in the Dollar was facilitated to a large extent by the expectations of high inflation and the consequent rise in interest rates especially the bond yields. The bond yields shot up in other markets as well. But this sudden rise in yields has cooled down a bit with the employment numbers not so encouraging of late about the strength of the recovery. The Fed has also been continuing with its accommodative stance and had state that till sustainable growth reappears they will not carry out any policy modifications. The 10 Year US Treasury has slumped to below 1.60 % thereafter and it stays within a narrow range. Bearish bets and dollar short positions have been initiated by many market participants in view of the bleak prospects of a rise in dollar interest rates in the immediate term. It is also a fact that the global recovery led by China, and countries like Germany and France is already on course and that should also lend more support to the non-dollar units. In other words, there is an improving sentiment towards non-US markets at this juncture. The picture that is emerging is quite contrary to what was prevailing last one quarter, and so long as the Fed would remain dovish, and the perception that it may take more time for the US economy to start again on a faster path to growth may keep the currency under some pressure. There is also a view that the likely changes in the US tax structure proposed by the new administration is also causing some heartburn among the investing community. But one needs to be careful not to ignore the power of the dollar to make a quick upturn. The course of the Rupee may be guided to a significant extent by the inflows and outflows on account of the foreign portfolio investors in the coming months