The Pace of Tightening Slows…

The Policy Action

RBI has hiked the Repo Rate by 35 basis points taking the policy rate to 6.25%, and the SDF rate to 6.00%. The policy action was on expected lines, the central bank was seen reducing the pace of rate hikes in the wake of moderating inflation (as per the latest readings), growth risks and taking into consideration the lag effect of rate hikes done so far.

The Background

➢ Before this policy, the domestic rates had been hiked by 190 bps to control inflation. The lag effect with which monetary policy action percolates down in the economy needs to be taken into consideration.

➢ The global economic outlook is one of sluggish growth. Global growth is set to lose momentum as monetary policy actions tighten financial conditions and as consumer confidence weakens with the rising cost of living.

➢ Globally inflation still remains elevated and persistent, however, there are signs of some moderation in price pressures. On the domestic front as well, the CPI based inflation eased to 6.8% in the month of October 2022 from 7.4% in September 2022.

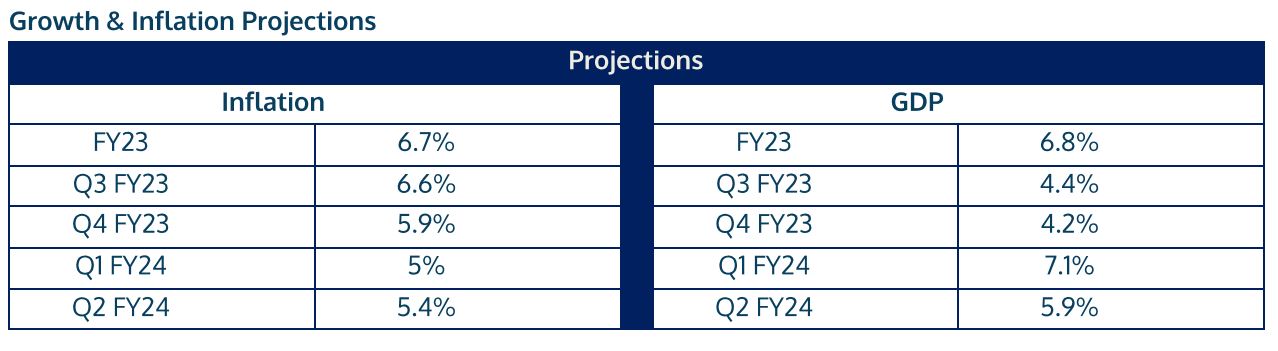

➢ The inflation trajectory may trend lower, but the headline numbers are still seen by RBI as staying outside its target range till at least Q4 FY23.

RBI on Inflation – “Global demand is weakening. Unabating geopolitical tensions continue to impart uncertainty to the food and energy prices outlook. The correction in industrial input prices and supply chain pressures, if sustained, could help ease pressures on output prices; but the pending pass-through of input costs could keep core inflation firm. Imported inflation risks from the US dollar movements need to be watched closely”.

RBI on Growth – “Robust and broad-based credit growth and government’s thrust on capital spending and infrastructure should bolster investment activity. The economy, however, faces accentuated headwinds from protracted geopolitical tensions, tightening global financial conditions and slowing external demand”.

Perspectives

The policy action was on expected lines, the central bank was seen reducing the pace of rate hikes in the wake of moderating inflation (as per the latest readings), growth risks and taking into consideration the lag effect of rate hikes done so far. The US Fed is also expected to tame its pace of rate hikes as inflationary pressures are seen receding over the next few months; given the considerations to maintain the currency yield it becomes a critical factor supporting the RBI to moderate its pace of rate hikes.

Going ahead the RBI may effect one more rate hike in its Feb policy, as the central bank expects the inflation to remain outside its target range till Q4 FY23. If the inflation numbers progress in line with the projections, the real policy rate may turn positive towards the end of the financial year, leading to RBI considering a pause. The short term rates may see some hardening going ahead as we approach the end of financial year, seasonally a tight liquidity period. The demand for funds coupled with a weak deposit growth may lead to short term rates inching higher. The investors with a shorter term investment horizon may consider investing at extreme short end of the yield curve to lock-in the higher yields. From a medium term perspective, SDL focused target maturity funds may be considered. The longer end of the yield curve is expected to trade in a range bound manner as the growth and inflation numbers are coming in line with RBI’s projections. The 10yr may test higher end of the range of 7.25% – 7.45% in case of adverse developments on the inflation front.