Further to the note titled, “Bond Funds: In the Light of Robust Processes”, from Bhavesh Sanghvi, CEO, Emkay Wealth, on the real issues, immediately after the FT Event, we are pleased to share this brief note on the consequences of this event for the near future.

A Crisis of Liquidity?

There is a liquidity glut in the interbank market. The total liquidity in the interbank market stands at Rs.7 Lakh Crs, one of the highest liquidity levels ever in the domestic market. The essence of this surplus liquidity position is simple – that there cannot be a liquidity crisis at this time and any liquidity shortage that is felt is actually not a liquidity crisis. There is no issue that this surplus is not capable resolving. Then what is it that we are facing at this juncture?

A Crisis of Confidence

There is a crisis of confidence. It has been brewing for some time now. The crisis of confidence actually started early on when the ILFS fiasco happened. However, it waned away with government taking a few steps to ameliorate the situation. Investors have either lost their money, partially or fully, or are yet to get their money back. Shortly after that came the NBFC crisis. NBFCs were not able to mobilize funds even at a rate, due to the lack of confidence in the sector. This lack of confidence was the result of the asset-liability mismatches which the sector has been building up and the presence of huge leverages etc. The market lost confidence in some of the entities which were soon reflected in their stock prices too. The conditions improved somewhat due to some measures initiated by the RBI over the last one year, but getting money was always a problem for NBFCs.

The entities carried low credit ratings as the rating agencies enhanced their rigour of ratings after the ILFS event. RBI also mentioned in its policy statement the need to channelize credit to some of the sectors including NBFCs which form the backbone of the financial system, especially when it comes to a bulk of retail loans. This was the genesis of the crisis of confidence. The fall in economic growth and the economic sluggishness, and now the pandemic has put immense pressure on smaller companies and enterprises. This has adversely affected their interest and debt servicing capacity.

Credit Risk Portfolios of Mutual Funds

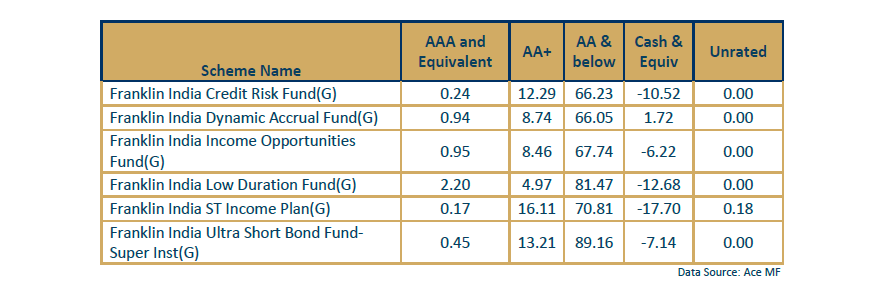

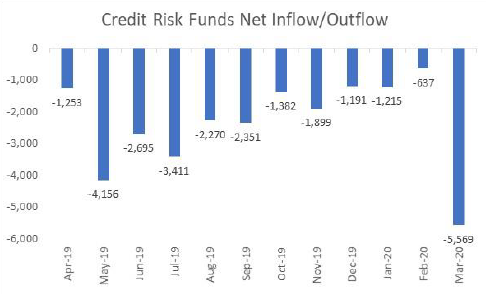

A major chunk of the credit risk portfolios of mutual funds contain papers or instruments which have low credit rating. These are available at a discount to the AAA rated papers, and therefore, the portfolios carry higher yields. But they carry a higher risk of default on repayment of principal as also on the periodic interest payments. Stressful economic conditions and economic crises trigger defaults and delinquencies. It is the quality of the portfolios which is the issue, and the inability to liquidate the portfolios to meet huge redemption and continuous requests from investors that has led to the current situation.

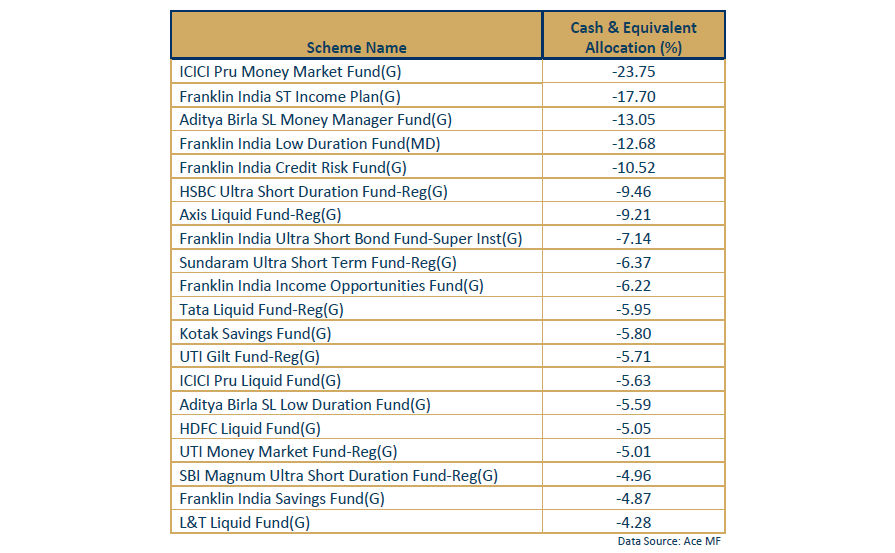

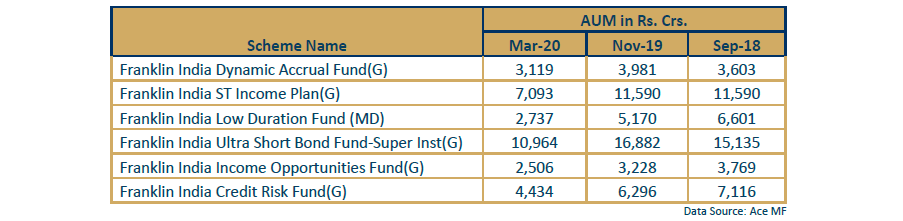

Mutual funds have been facing redemption pressures on the credit risk funds all the time, and it was more pronounced in the last six months. While redemption pressures mount the tendency is to liquidate those papers which can be easily liquidated, and they hold the rest. When huge redemptions come through then you have recourse to only support from banks through borrowings which comes at a cost. This leads to negative cash on the portfolios and an interest cost which pulls down the asset value of the portfolio. This is actually the crisis or what is behind the crisis. It is a crisis of confidence. There is falling investor confidence due to the low quality of the papers and the progressively lower returns, and also due to the issues faced in the past. On the other hand, there is increasing difficulty in liquidating portfolios to pay the investors.

What do we do in such situations?

(i) If the portfolio is of bad credit quality, then the ideal thing would be to exit the investment. Actually, this is something that needs to be taken cognizance of at the time of investment itself. Avoiding such portfolios is crucial to maintain the earning ability of the portfolio. All credit funds belong to this category and there are a few exceptions. The earlier one exits the better it is. At Emkay we have not recommended any credit risk funds in the last two years or more. The Emkay EnEf Model penalises low credit quality by assigning lower and lower scores to funds that have too much exposure to low quality instruments in the portfolio.

(ii) Stay invested even if the cash component is negative because portfolios with good accruals gradually get an upper hand over the cash cost as things stabilise, and as the cash component becomes low or zero. This a rational thing to do as the investment was originally contracted with a view to hold it for at least two to three years. Crisis of confidence is not something that lingers on for a long time because it ultimately does harm to the economy.

(iii) It is possible to switch from bond portfolios to overnight or liquid funds or ultra short term funds by which you bring down the duration to the extreme short end of the curve. This will offer some insulation to the portfolio both from interest rate and credit risk. In the case of investors who may be very conservative based on their risk profile can be suggested this alternative.

What could be the turn of events?

(a) It is highly likely that mutual funds may be faced with redemptions in the coming weeks. But there could be confidence building measures that may come from the SEBI and the RBI. Some mutual funds themselves could initiate some measures by which the situation could be brought under control.

(b) Since it is a crisis of confidence, similar to the one faced briefly during the 2008-09 economic crisis, it is highly likely that the RBI may announce some measures like opening a window for repos for mutual funds so that the mutual funds can get the funds from the RBI directly or through banks whenever they need it. This will bring back the much-needed confidence in the market and in investors.

(c) Mutual funds may impose some limited restrictions on the number and amount of withdrawals by investor. These are reasonable measures intended to protect the interests of the investors who wish to stay invested as against those who are rushing in to exit in panic.

Of all the measures, the more effective panacea for the situation would be the support from RBI either directly or through banks, in very clear terms. This will bring to an end the crisis of confidence.

Need for Robust Selection Methodology

It is times like this that bring us closer to realizing the importance of an efficient scheme selection model to aid selection of the better schemes or funds from among large number of products. The Emkay EnEf Model is a parametrized scheme selection model which has a track record of more than 15 years, and it has withstood the test of time. The beauty of the model is that it evaluates products based on both risk-based and return-based factors, and not just based on return-based factors. In fact, both sets of factors have more or less equal weightage. The model has a four-stage selection process which starts with application of hygiene factors to eliminate products which are from asset management companies which have tiny AUMs and very small scheme AUMs. If you take a closer look at some of the tail end credit risk product from small AMCs, the worst performance is from those entities. Once the schemes come through the hygiene factors, they move on to two phases of ranking using the parameters. The quality of the portfolio is a major factor in the ranking of debt or fixed income funds. The lower the quality of the portfolio, the ranking model will punish the scheme and puts it much lower in the order. This was precisely why none of the FT debt schemes found a place in the Emkay Wealth recommendations. The most important lesson of this passing phase is twin-fold –

(a) the fundamental importance of risk and suitability assessments based on individual risk and product profile, and

(b) the need for reliance on robust product selection methodologies while investing.