The response of the markets to the Fed statement is no surprise. An extended period of low interest rates means three things, one, the current economic conditions are extremely distressful, two, the time taken for recovery is likely to be longer than expected, and three, an extended period of low growth. If a long-drawn struggle for growth is anticipated, it naturally has consequences for corporate profitability and earnings growth, and this may not be good for the financial markets. This is the first impression after a reading of the Fed statement.

Fed Statement issued on Sept. 16, 2020, has kept the target range for Fed Funds Rate at 0 to 0.25%, and the inflation target at an average of 2%. The accommodative stance of the policy continues. The inflation rate is running persistently below the long run rate of 2% and the Fed is targeting higher inflation which is moderately higher than 2%. To summarise, the three distinctive features of the Fed policy are, one, the rate of discount is 0 to 0.25% which is likely to continue at the same level for years to come, two, the inflation targeting will be average inflation of 2%, and three, the quantitative easing also to continue for an extended period of time.

On the major objectives and tools of policy the Fed Chairman mentioned the following in his public

discussions:

On Quantitative Easing: “…. will continue to increase our holdings of Treasury securities and agency mortgage-backed securities at least at the current pace. These asset purchases are intended to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses”.

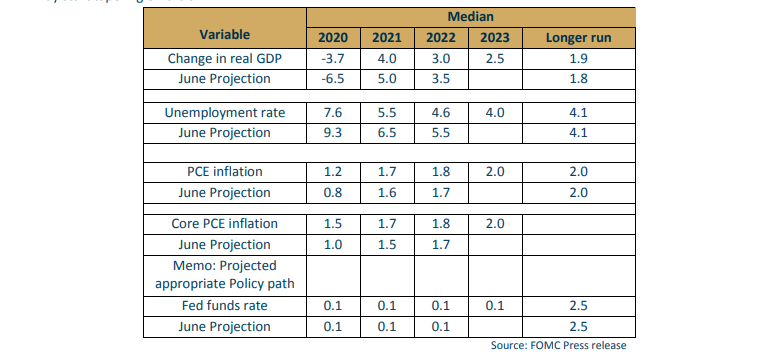

On Labour Market & Employment: “In the labour market, roughly half of the 22 million jobs that were lost in

March and April have been regained as many people returned to work. The unemployment rate declined over the past four months but remains elevated at 8.4 percent as of August…….FOMC participants project the unemployment rate to continue to decline; the median projection is 7.6 percent at the end of this year, 5.5 percent next year, and 4 percent by 2023”

On Inflation: “The pandemic has also left a significant imprint on inflation. For some goods, including food,

supply constraints have led to notably higher prices, adding to the burden for those struggling with lost income. More broadly, however, weaker demand, especially in sectors that have been most affected by the pandemic, has held down consumer prices, and overall, inflation is running well below our 2 percent longerrun objective. The median inflation projection from FOMC participants rises from 1.2 percent this year to 1.7 percent next year and reaches 2 percent in 2023.”

On Growth: GDP growth numbers are projected to pick up as the US moves into 2021 and then in 2022, after which it may start tapering off a bit.

View: Going by the recovery seen so far in economic activity in the US and elsewhere, it may be seen that the recovery has been faster than expected. In the context of the US the most striking factor is the gains in employment registered in the last three months. Therefore, the overall economic recovery would also keep pace with the improvements that we are seeing now. It is less likely that conditions would become still worse against the background of the pandemic from the current levels. With a pick in the economy, and consequent gains in employment, the price level is likely to rise, and the Fed may change the policy stance at an earlier date than what is widely expected. Therefore, the thesis that the Fed would be in an accommodative mode for many years, may not be valid beyond the next three or four quarters, at best.

Also, the implicit commitment by the Fed to maintain low interest rates and utilise all policy tools at its disposal to achieve the inflation, growth and employment targets is positive for equity markets. The indications of maintaining liquidity support are risk assets supportive, as the pumping-in of fresh money by the central bank may continue to find its way to capital markets. At the margins, the policy stance is also supportive of gold, with low US$ interest rates, gold may find favour with investors in a low growth scenario.