Early Hints

You may be able to recall that in the Emkay Navigator, June, 2021, we had discussed the US-centric developments as

follows: “The focus of attention is gradually shifting again to the US recovery, away from the impact of the second and third wave of the pandemic. While growth is happening in the US, and the improvements in employment are good, the job gains are not entirely matching up to the estimates or expectations. With major spends including payments directly into people’s hands, and a major infrastructure plan which is in the works, it is less likely that secondary parameters like employment is not going to accelerate sooner than later. In the last few weeks, there have been statements from several Fed officials which sounded like they are preparing the markets for a tapering off the bond buying program. This may be initiated by reducing the quantum of buying or the frequency.

There is a strong speculation that the Fed is probably at the discussion or planning stage to reduce the liquidity in the system given the recent retail inflation numbers. This is amidst the repeated assurances from the Fed that they would remain accommodative till the economy stabilizes and growth revives sustainably. The statement from the Treasury Secretary, Janet Yellen, who was herself the Fed Chair for some time, that higher interest rates are good for the US economy, has not confused anyone in the least but confirmed the thinking that rates could start rising now. Central banks prepare the markets at crucial points in time.”

Moving up the Target

After the recent FOMC meeting, the Fed has moved up its target from 2024 to 2023 for the first hike in interest rates, that is a potential rate hike in future faster than expected. Two hikes in 2023 is the estimate. In fact, a significant number of the FOMC members, though not the majority, expect that there could be hikes as early as 2022. This is the first indication from the Fed that the current accommodative stance may continue for a while, but based on the growth inflation numbers, there could be modifications to the policy. This converts most market participants to be expectant of possible rate changes in the coming FOMC meetings.

Rising Growth and Inflation

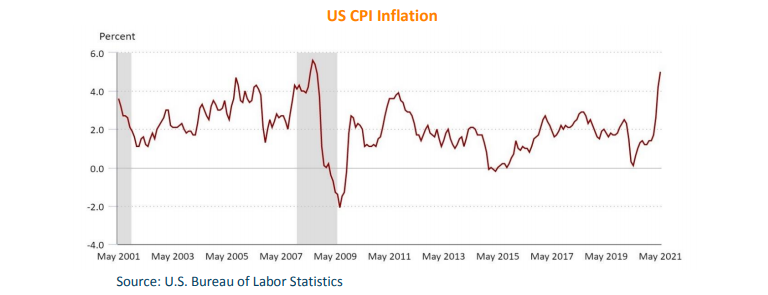

These broad hints from the Fed comes after strong numbers both in growth and inflation. US first quarter GDP growth was at 6.40% as against the expectations of 6.50%, but a major surge in the economic activity after the pandemic battered the economy. It was Q2 of 2020 which saw the biggest fall in US growth, as it plunged by 31.40%. There has been allround improvement ever since that time. Consumers account for almost 68% of the economy, and their spending rose by 10.70% in the last quarter, compared with a 2.30% rise in the previous quarter. The spends on goods increased 23.60%, and on services the expenditure increased by 4.60%. What is behind the surge in the economy is the fiscal stimulus packages and the resultant spending. The first fiscal stimulus package was to the tune of US$ 2 trillion of which US$ 1.20 trillion was direct cash payments. The second introduced by Biden is US$ 1.90 trillion. These two packages put together and the direct cash which the eligible public got is quite a large amount of money which has helped aggregate demand to rise over the last few months. What is more ambitious is the new infrastructure plan, which amounts to US$2 trillion. These massive spends are going to take the US economy to a new era of growth and rising demand, employment, and output. The government will collect higher corporate taxes, which is likely to be revised upwards from 21% to 28% and utilize the same for the projects. There is a clear accent on the demand side as far as counter cyclical policies are concerned, and they are more likely to bear fruits faster. The policy anchoring in the US is an average inflation of 2%, and the latest retail inflation number is at 5%. Studies of the US economy and markets have found evidence to the fact that only an inflation higher than 3% and rising can start denting growth.

Consequences

Rising interest rates in the US could pull down the prices of commodities especially gold in the immediate term. With the currency yield expected to move up gradually, the US unit may gain against major currencies. This may limit the rise in commodity prices. But it is important to note that any sustained rise in prices or inflation would rekindle the demand for gold. Retail inflation is a kind of a global problem now with many economies facing a surge in prices due to high oil prices or due to rise in demand post the pandemic. Under such circumstances when rates may rise in the US it will not be possible for domestic interest rates to move down, and in any case, local rates are expected to be stable to higher at the long end of the curve. The Fed moves may influence RBI’s approach to interest rate policy though it may not alter the basic commitment to an accommodative stance. However, as indicated in the CPI update (FinSights June 12, 2021), such conditions or developments may result in the RBI gradually withdrawing the liquidity in the system. Rising US inflation, accompanied by tapering of the bond buying program, may reduce the extra ordinary flows into the Emerging Markets while normal flows from long term investors like pension funds may still continue. While a faster growth will endow corporates with higher sales and revenues, sustained high inflation generally reduces the purchasing power and prompts people to spend less or postpone spending.