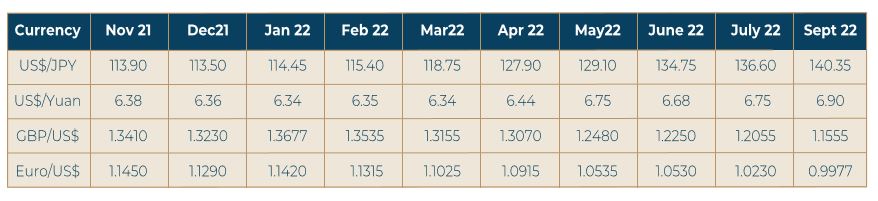

The US Dollar is galloping its way up against all currency majors and it is progressively reflected in the Dollar Index. What lends strength to the US Dollar is the rising interest rates occasioned by the tight money policy followed by the Fed. With an affirmation from the Fed that the same policy will be continued till inflation is contained, gives more room for the Dollar to appreciate. The inflationary conditions and the issues and problems created by the Russian invasion of Ukraine are going to adversely affect the economy of Europe. It is felt that as winter approaches the conditions may become even more grave with likely shortfall in supplies of gas and fuel. The ECB response to the inflationary pressures were a bit tepid to begin with, in comparison to the action taken by the Fed and the BOE. The peripheral countries have already started feeling the heat due to the variations in climatic conditions and the uncertainties arising from the war in Eastern Europe. In the UK the markets are waiting for the resolution of the leadership question in the coming week and the person elected to the position would hold the key to the approach to the economic issues. One of the top losers in the currency markets is Yuan and the level of depreciation amply reflects the deteriorating internal economic conditions as also the likely external environment. Unless there is tangible economic recovery and pick up in external trade the currency may remain weak. The Rupee has been able to remain a shade lower than the Rs.80 mark against the Dollar, due to the intervention by the central bank and some sporadic inflows that came into the equity market. The pressure on the Rupee will persist for more time and a turnaround would depend mainly on the investment flows from abroad.