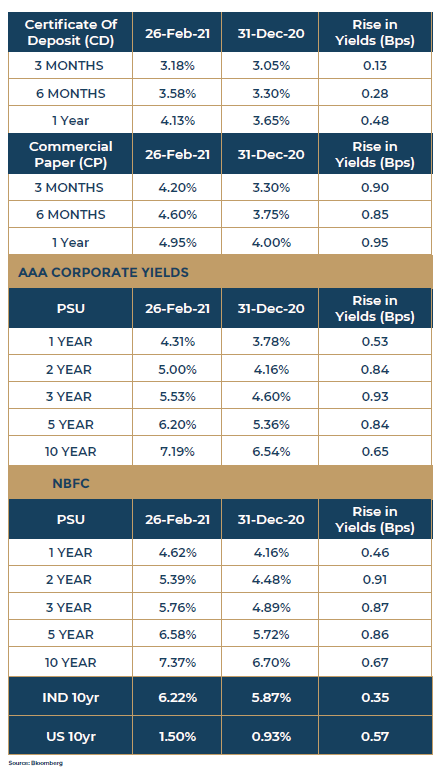

Yields or interest rates have been edging higher during the course of the last three months and it will continue to be so for some time. The immediate reasons are – RBI hiked the CRR which was going to increase the borrowing and lending costs for banks, there has been some pick up in credit growth or demand for credit, the central bank had already started the normalization process in early January, inflation expectations were gradually trending higher on account of the likely impact of higher fuel prices etc. The market rates actually moved up in the last three to four months as you can see from the following table:

“While the benefit of liquidity will continue to be available for the markets, the emerging shades of tightening cannot be ignored. It may be recalled that the RBI had, earlier in January, moved back to the daily variable repo as part of the normalization process. That was the first indication of the central bank gradually moving things back to a normal days’ arrangement. But the message is that there is need for closer tracking of rate movements, and the increase in the pace of normalization which is quite likely in the coming days should be monitored for both exiting and fresh investments. Till the time the process of normalization does not come to a close the market rates may gradually inch higher. Therefore, fresh investments may be made only at the very short end of the curve. Wherever, longer end investments are there, the same may be reviewed to ascertain the need for a change in the portfolio against a changing scenario.” (Fixed Income Update: Navigator Feb 21, & Monetary Policy Review, Feb.5 21).

Read More in our latest issue of Navigator