The Real Estate Investment Trust (REIT) is structured like Mutual Funds (MFs), in the sense that it allows pooling of investor money to buy a particular asset. REITs, as the nomenclature suggests, invest in income generating real estate assets. The investors benefit by way of dividend-like income and also by valuations gains in the underlying real estate assets over a period of time. To provide liquidity, REIT units are compulsorily listed on stock exchanges. The three avenues available to investors currently in the listed REITs space are Embassy Office Parks, Mindspace Business Parks and Brookfield.

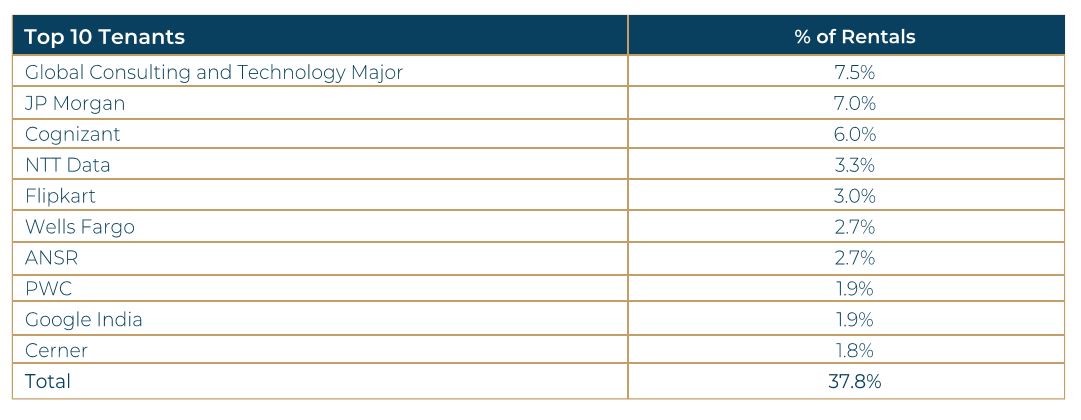

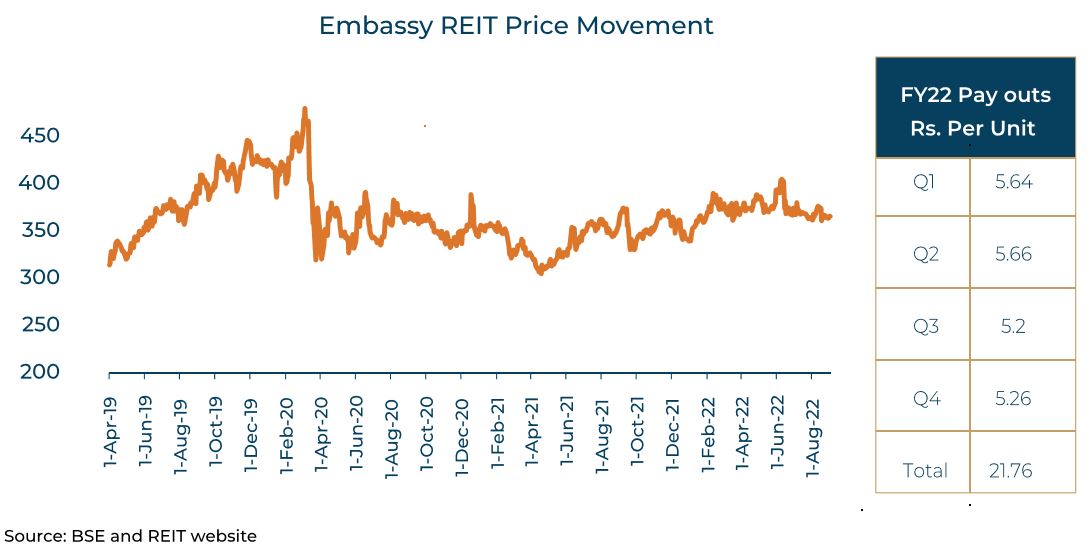

Embassy Office Parks

Embassy Office Parks is India’s first publicly-listed Real Estate Investment Trust (REIT). It owns and oper- ates a 42.8 million square feet (msf) portfolio of eight office parks and four city-centre office buildings in Bengaluru, Mumbai, Pune and the National Capital Region (NCR). Embassy Office Parks’ portfolio has 33.8 msf completed by area and is home to 214 of the world’s leading companies. The portfolio also comprises strategic amenities, including four operational business hotels, two under-construction hotels, and a 100MW solar park supplying renewable energy to tenants.

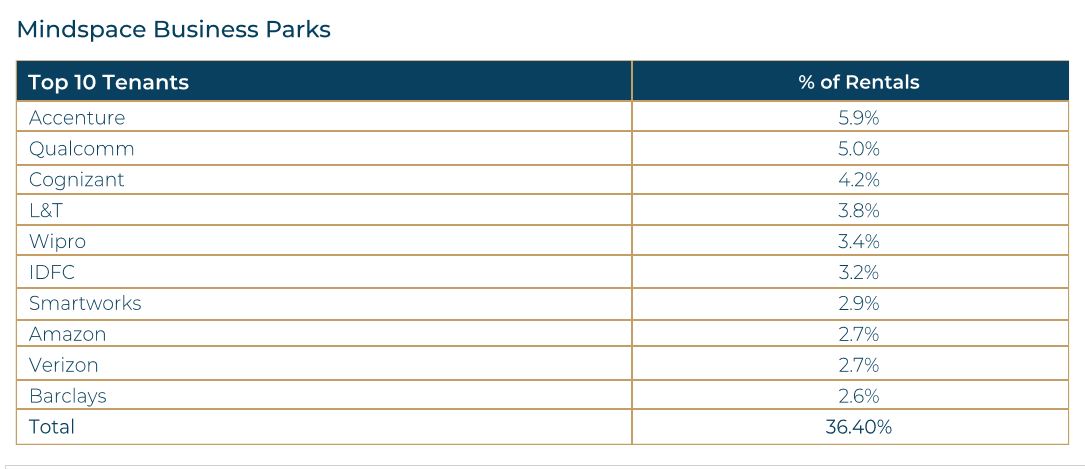

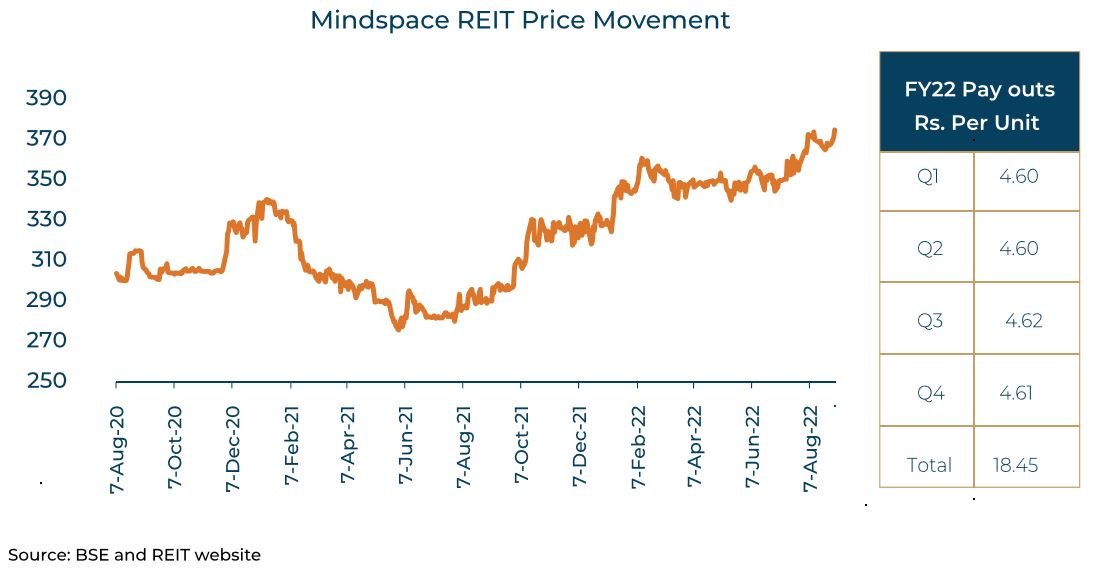

Mindspace REIT is one of the largest Grade-A office portfolios in India. It has a total leasable area of 31.8 msf out of which 24.4 msf is completed, with a committed occupancy of 85.6%. The REIT operates five integrated office parks housing 57 buildings in the key areas of Mumbai Region (41%), Hyderabad (40.4), Pune (16%) and Chennai (2.6%). The REIT enjoys a high-quality tenant base with 77.5% of the rentals gen- erated from MNCs. It aims at providing integrated office parks by making available amenities such as club house, restaurants, food plazas, outdoor sports arena, etc