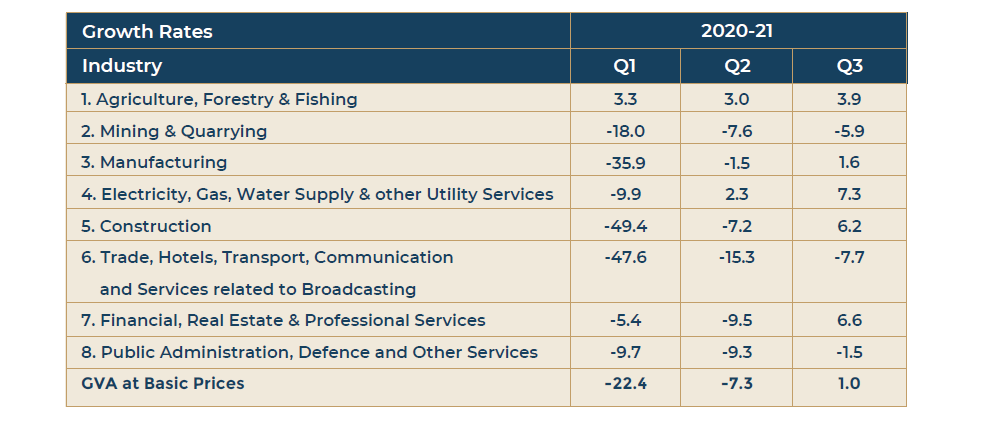

The GDP growth number for the last quarter, Q3FY21, at 0.40% corresponds to more or less what most of the market participants and analysts had expected. The GDP has reported positive growth after two consecutive quarters of contraction (-24.4% for Q1FY21 and -7.3% for Q2FY21). That should bring in some amount of relief. The reason for this is two-fold. First, economic growth is in the positive territory, that the economy is growing, though at a borderline rate. Two, that the days of negative growth, an economy hammered down by the pandemic, is more or less behind us. The movement in the components of the GDP number also tells us some of the areas which are lagging and where needs to be better concentration of efforts so that we realise much higher growth in the coming quarters.

The economic rebound is the result of continuing improvements in agriculture and industry, which have recorded growth of 3.90% and 2.70% respectively. While mining witnessed a decline of -5.90% there was uptick in construction to the tune of 6.20%. Manufacturing too is in the positive territory at 1.60%. The improvements in manufacturing and industry are already quite visible in the corporate performance reported in the last two sets of quarterly earnings results. While Q2 performance was mainly due to enhanced operational efficiencies, Q3 scaffolded it further with gains in the bottom line.

The very important consumption demand, which is measured by Private Consumption Expenditure, continues its contraction, with a decline of -2.40% in Q3. The consolation is that the rate of contraction has slowed down from 11.30% in Q2. The investment demand or the Gross Fixed Capital Formation reflects a capital formation which is turning positive after a declining spell of over one year with a 2.60% growth. This is a crucial indicator of investment demand, and what is important is sustaining this momentum. The section under the head, public administration, and other services, which stands for government spending, shows a decline of -1.50%, mainly reckoned as due to the weak growth in other services.

Read More in our latest Issue of Navigator