India enters a technical recession with two consecutive quarters of economic growth contraction. The GDP contracted by 7.50% in Q2FY21, as against the 23.90% contraction seen in Q1. It is pertinent to note that the rate of GDP growth is at an 11-year low, as compared to 4.20% in 2019-20, and an expansion of 6.10% in 2018-19. Therefore, it is to be understood that the slowdown in growth accentuated, and it converted itself into a recession, with the pandemic and the consequent lockdown, and the demand destruction that followed.

A reversion to normalcy was expected as soon as the situation improved, which is reflected in the slowdown in the

sluggishness, seen in the Q2 numbers. Contrary to the general expectation of a contraction of around 8%, the number at 7.50% looks much better, but that is no guarantee of any sustained improvement unless the government spends more. The Keynesian prescription for recession is pushing up aggregate demand through government spending. And it works. But one should draw comfort from the fact that the GDP number is better than expected, and the final GDP number for the whole year may be a shade better than what was thought before, could be somewhere between -7% and -8%. This also assumes that growth may be positive, at least mildly positive, in the coming two quarters.

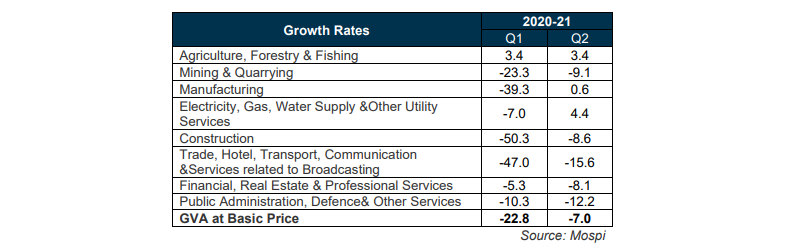

While agriculture remains at 3.40% growth, other key components like mining, construction, hotels, transport, and real estate remain in the contractionary or negative mode. Some of these areas are labour intensive, and their dependence on even migrant labour is extremely high, like construction and real estate. Unless labour moves in, full recovery in these sectors may take much more time. A closer reading of the GDP numbers, along with core sector and IIP numbers would make better sense of some of the sectoral lags. The data on small businesses and smaller corporates, and the informal sector, also needs to be incorporated to see the actual ground level improvements, which happens at a later stage.

Private Final Consumption Expenditure and the Gross Capital Formation have shown improvement, whereas

Government Final Consumption Expenditure has fallen. The reasons for the pickup in expenditure can be linked to the unleashing of the pent-up demand and the consequent surge in demand. There has been some movement due to the demand emanating from the festive season. Here also, what needs to be considered is the fact that the rise seen here need not necessarily be sustainable, and only over Q3 numbers, we will get sufficient data to confirm the trend of improvement.

The economic contraction seems to be bottomed out as of now, but there are a few factors that may overturn this

nascent growth recovery. The first one is a serious return of the pandemic in its second or third wave. This can disrupt everything and put the clock back again to where we were at the start of the pandemic. But the likelihood of such a serious disruption seems to be very remote. A second and more critical threat to growth may emerge from rising inflation. CPI as per the last reports is at 7.61%, and food inflation is at 11%. In fact, over the last couple of months, food inflation has spread to all major food items apart from fruits and vegetables. Something that is still more worrying is the rise in oil prices. Brent is edging closer to US$ 50 per barrel, and with winter just around the corner, the prices may not come down. Higher oil prices may have an inflationary impact unless some of the local taxes on fuel are brought down.

The inflationary pressures may persist for another two or three months, and if it gets prolonged for any reason, then

there could be action from the RBI to contain the price level because the central bank may never be a party to imposing a tax on the common man by way of a higher price when they are already going through too much. While central banks elsewhere are praying for higher inflation, whether it is the US or the EU, we will not be in a position to accommodate higher prices even for a short time.