Arbitrage Funds, Now?

Most often the short-term investment landscape is dominated by overnight funds, liquid funds, and ultra-short tern funds. In the recent past due to volatility in the short-term rates some of these schemes except overnight funds have given occasionally negative returns. While such volatility may be a very short-lived phenomena, quite often the opportunity to invest into arbitrage funds for better returns does not catch the attention of investors. In the following paragraphs, we have prepared a case for investing a part of the short-term surplus cash into arbitrage funds.

Since April1, 2020, dividend is taxed at the marginal rate of taxation of the investor, and the tax status of returns from arbitrage fund investments has become clearer now. They become more comparable to other debt funds in taxation while delivering consistently higher returns compared to some of the short-term debt products.

The Investment Strategy

Arbitrage entails buying and selling of the same securities in different markets or in derivatives with the aim of taking advantage of the divergent prices of the same asset. In other words, arbitrage simply targets to benefit from price discrepancies and does not take a directional view in asset prices.

The main strategy employed is cash-futures arbitrage. Under normal market conditions, there is a positive price gap between futures price and price of the underlying of a stock. The Arbitrage Funds capture the benefit of this price differential, by buying the stock and shorting or selling the futures of the same stock, thereby locking-in the gains equivalent to the price differential.

Example: If the stock price of ABC Ltd. is trading at Rs. 100 and futures price of the same stock is trading at Rs. 110, an arbitrage fund would buy ABC Ltd. in cash market and sell the futures, thereby, locking-in a gain of Rs. 10. On the day of F&O expiry ABC Ltd. share price is trading at Rs. 105, as cash and futures price converges on the day of expiry. The fund would have made a gain of Rs. 5 on the both the transactions, long as well as short, and realizing the originally locked-in profit of Rs. 10. As you can see from this example, the fund will not take any directional bets and will only try to gain from the cash-futures spread.

Taxation

The risk-return profile of Arbitrage Funds is quite similar to that of Liquid Funds, both the categories are short term investment avenues with minimal market risk. The key aspect where Arbitrage Funds score over Liquid Funds is on the taxation front. Arbitrage Funds are classified as equity funds and thus are subject to STCG base tax rate of 15% as against the base tax rate of 30% (assuming the investor falls in the highest tax bracket) for debt funds. Further, as discussed above, in the current scenario wherein credit risks have come to the fore, Arbitrage Funds provide an investment alternative with minimal exposure to credit risk.

The Suitability

Arbitrage Funds are suited for all investors who have short term cash to deploy. But the one difference is that liquid fund investments may be done for 7 days or more, the investments into arbitrage fund should be for at least a month at the minimum, though the recommended horizon is three months plus.

Given the investment strategy of Arbitrage Funds, the cash-future trades are locked-in closer to F&O expiry. The trades so entered are typically held onto till the next expiry, and that is the time when trades are unwound, and the locked-in gains are realized. In the interim period, from one F&O expiry to the next, owing to marked to market (MTM) impact, the NAV movement may be volatile, and the returns may sometimes turn negative. These factors are important as they influence the entry and exit points in Arbitrage Funds. In order to minimize the impact of MTM-induced volatility, it is recommended to make investments as well as redemptions more or less in line with the F&O expiry calendar.

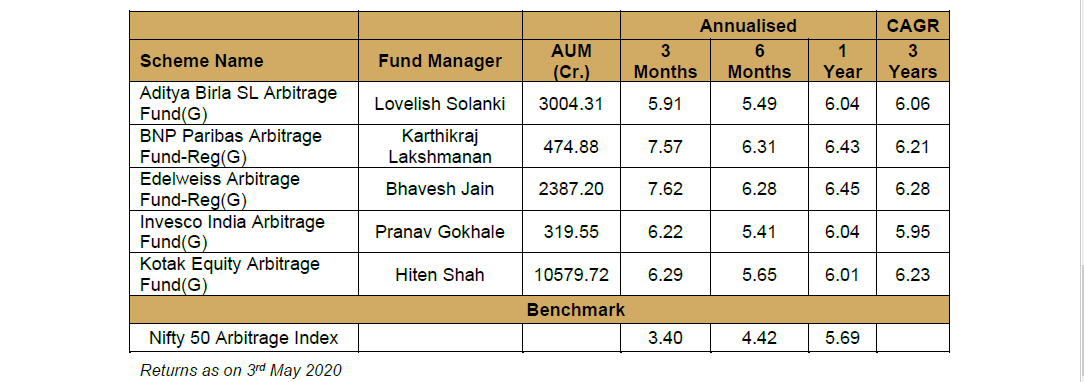

Performance of Arbitrage Funds