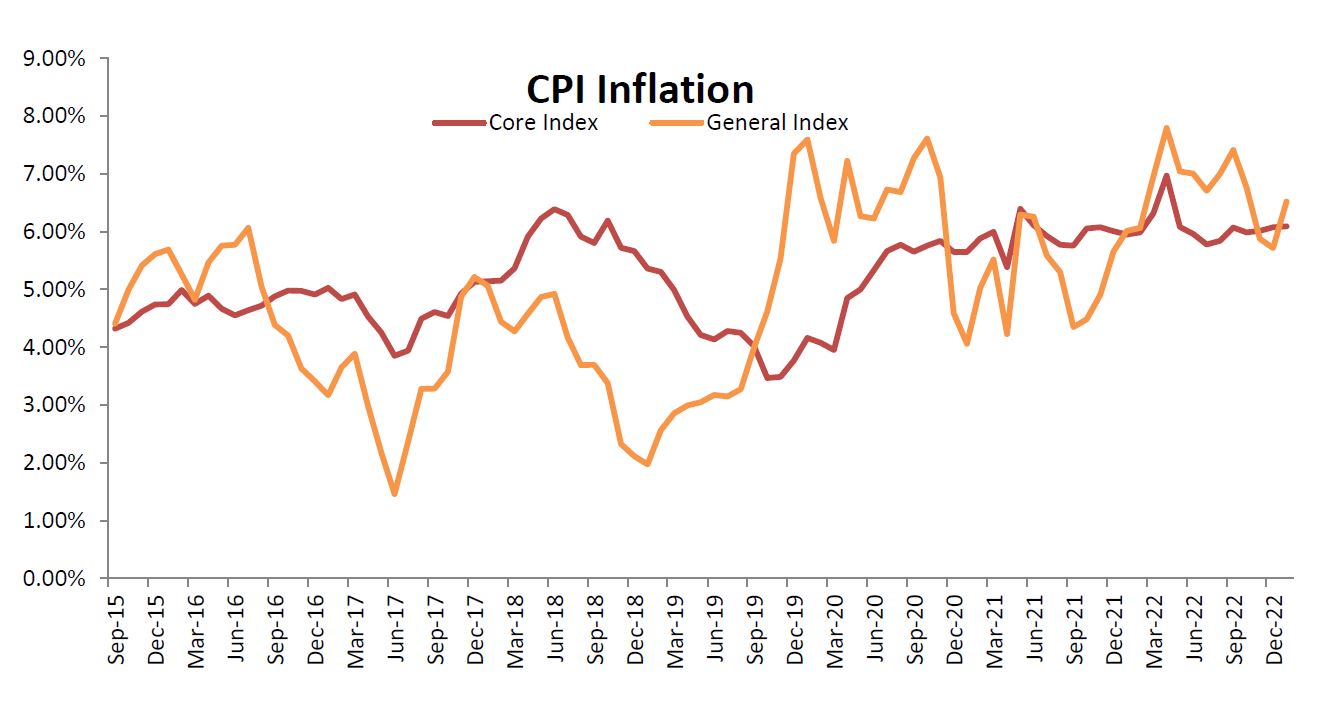

The CPI based inflation surged for the month of Jan’23 and was reported at 6.52%, a three month high. After easing for two consecutive months, the headline inflation numbers have surged again and has landed outside the RBI’s target range. The headline inflation number for the preceding month and for the year ago period was 5.72% and 6.01% respectively. The uptick in food prices and a sticky core inflation were the key factors contributing to the higher headline numbers.

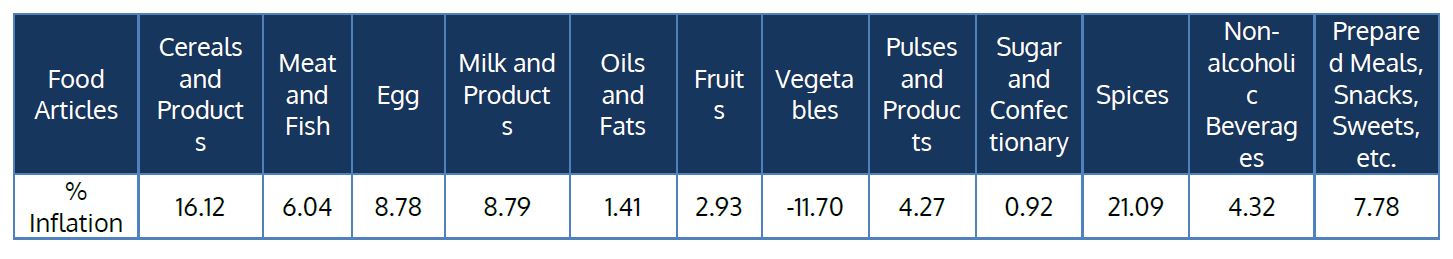

The trend seen in the Consumer Food Price (CFP) inflation over the last two months reversed in the month of Jan’23, as it witnessed a sharp uptick. The CFP based inflation was reported at 5.94% for the month of Jan’23 as compared to 4.19% in the preceding month. The food inflation gained momentum as was visible from MoM sequential numbers. Within the food basket, vegetables prices continued to ease whereas cereals, egg and spices witnessed inflationary pressures. The spike seen in prices for cereals may lead to food basket price remaining under pressure going ahead. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 9.08%, 10.84%, 4.62% and 6.21% respectively.

Fuel Price

The crude oil prices have been trading in a range of $80 to $85 per barrel over the recent past. Oil prices have been trading in a narrow range as there has been an equally strong pull from bearish and bullish factors. The recent news of US oil reserves increasing at a swift pace and the expectations of a recessionary scenario developing in the western hemisphere due to tight monetary policy is providing a cap on gains in oil prices. On the other hand, the opening-up of China from pandemic related restrictions and the robust demand from India are the critical bullish factors that may push oil prices higher over the course of the year. Overall, Brent seems to be stable at the current levels with more of upside risks as geopolitical uncertainties are still brewing.

Core Inflation

Core inflation remains sticky, with no signs of inflationary pressures waning over the near term. Even as the headline inflation had eased for two consecutive months the Core CPI remained largely stable around the 6% mark. The core inflation (ex food and fuel) came in at 6.09% for the month of Jan’23. The RBI has noted in its recently declared monetary policy document that, “the ongoing pass through of input costs, especially in services, could keep core inflation at elevated levels.” The Clothing and Footwear inflation too has been maintaining a run rate of close to double digits. The services industry bore a severe brunt over the last two years and is now witnessing strong resurgence in demand, and with it pricing power.

Outlook

The base case market expectations, post the back-to-back easing seen in headline numbers, which had started veering towards a temporary peak in inflation and policy rates may get modified with the latest numbers breaching the RBI’s target range, and also the positive real rate threshold.

With regards to inflation and RBI’s stance we had mentioned in the previous issue that, “The easing of headline inflation has largely been a function of correction in food prices, one of the volatile and demand inelastic components along with fuel. The core inflation continues to be sticky and if the demand remains resilient the pricing power so attained may lead to further dearness in services industry. The risks of commodity led inflation transitioning to a services led one, may not allow RBI to lower its guard.” The RBI has further reiterated in its policy note that, “We have to remain unwavering in our commitment to bring down inflation. Thus, monetary policy has to be tailored to ensuring a durable disinflation process.”

The monetary policy may continue to be data dependent and the stance may not be modified till the time inflation is durably under control.