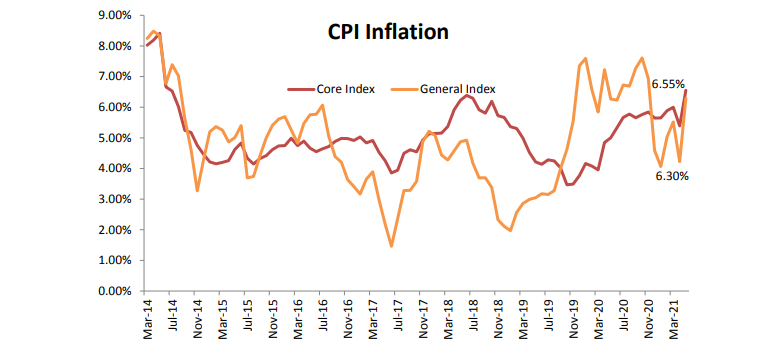

The CPI based inflation rose sharply in the month of May as against the expectations of a moderate rise from the inflation numbers of April month. The headline CPI inflation was reported at 6.30% for the month of May’21 as compared to 4.23% for the preceding month and 6.27% during the year ago period. A broad based rise in prices across the subcomponents pushed the headline inflation outside the RBI’s target range of 4% +/- 2%. The core inflation too continued to trend higher and has maintained a level above the headline number for the sixth consecutive month.

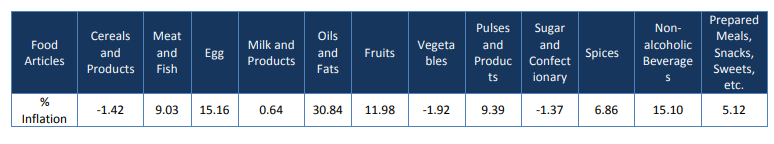

The Consumer Food Price (CFP) inflation after touching a near term low of 1.96% in the preceding month, surged sharply and was reported at 5.01% for the month of May’21. Despite the high base effect, the food price inflation soared in the month of May. While part of the sharp spike in food inflation can be explained by the supply disruptions due to lockdown and seasonal effects, the rise globally in food items also played its part. The inflation for Oils and Fats component in the food basket surged by 30.84%; India being a net importer of edible oils saw the pass through of rising prices in CPI inflation. The other food components to witness a double digit rise in inflation were Egg (15.16%), Fruits (11.98%) and Non-alcoholic beverages (15.10%). The prices of pan, tobacco and intoxicants component maintained an upward trend and reported double digit inflation. The inflation for other components such as Clothing, Housing and Miscellaneous too moved higher, with the risks slightly on the upside as economic growth improves.

Fuel Prices: The inflationary pressures emanating from the fuel maintained its upward trajectory and touched 11.58% in the month of May’21 as against 7.98% in the preceding month. The enhanced oil demand for US driving season, is one of the factors that is supportive of the higher prices. It is also worth noting that the recovery in economic activity in the US and Europe is on course, and the same may be true of the leading Asian countries too. This may also support higher oil prices though demand in Asia is yet to go back to the pre-pandemic levels. The production in the US which was at 13 million barrels per day just before the pandemic has touched almost 11 million barrels per day recently. Therefore, restoration of supply as well as demand is happening. Overall economic conditions warrant higher consumption and therefore, higher prices.

Core Inflation: The broad based rise in the sub-components of inflation impacted the core inflation numbers. The core inflation surged to 6.55% for the month of May as compared to 5.39% seen in the preceding month. The Pan, Tobacco and Intoxicants inflation has been in double digits for a major part of the last one year and it maintained the trend in the month of May as well. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 7.52% in the month of May as compared to 6.12% in the preceding month. Within Miscellaneous component, given the direct effect of rising fuel prices, Transport sub-component saw the sharpest rise in inflation at the rate of 12.38%. The Health sub-component too reported heightened inflationary pressures. As the lockdowns are gradually withdrawn, the demand for various services is only going to improve leading to further price pressures.

Outlook: The inflationary pressures have been on the rise over the last few months, but the latest surge in food and fuel inflation has pushed the headline numbers outside the RBI’s target range. The RBI may overlook the latest inflation numbers as the focus at the current juncture is to support growth, the RBI governor had in fact mentioned the need for central and state governments to take appropriate action. In line with other global central banks the growth concerns in the wake of the pandemic are finding precedence over inflationary risks. While the level of price rise may not necessarily be an immediate concern, the timing of the same may warrant attention from policy makers.

Even as the economy is grappling with the adverse effects of the second wave and the activity level is yet to recover fully, the headline inflation numbers have already surged ahead. The heightened inflationary pressures in a low growth environment may influence a swift normalisation of monetary policy once green shoots of growth are visible.

While the effect of spike in edible oil prices on food inflation may be transitory and may even normalise as supply

improves, the fuel inflation remains a key risk at the current juncture. The rising fuel price not only has a direct impact on headline numbers but seep into other components by way of second round effects, most prominently through transportation costs.