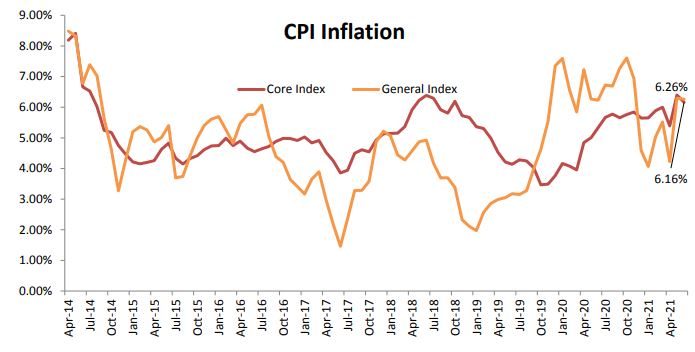

The CPI based inflation moderated marginally in the month of June but stayed outside the RBI’s targeted range for second consecutive month. The headline CPI inflation was reported at 6.26% for the month of Jun’21 as compared to 6.30% for the preceding month and 6.23% during the year ago period. The rural and urban inflation moved in divergent directions, while rural inflation moderated from 6.55% in May to 6.16% in June, the urban inflation hardened from 5.91% in May to 6.37% in June. The core inflation too moderated marginally in the month of June.

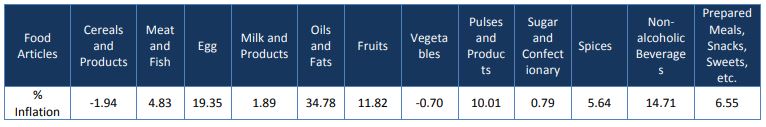

The Consumer Food Price (CFP) inflation continued to harden, though at a moderate pace, even with a supportive base effect. The CFP index inflation numbers came in at 5.15% in the month of June as compared to 5.01% in the preceding month. The inflation for Oils and Fats component in the food basket surged by 34.78%; India being a net importer of edible oils saw the pass through of rising prices in CPI inflation. The other food components to witness a double digit rise in inflation were Egg (19.35%), Fruits (11.82%), Pulses (10.01%) and Non-alcoholic beverages (14.71%). The prices of pan, tobacco and intoxicants component inflation eased sharply from 10.03% in the preceding month to 3.98% in the month of June. The inflation for other components such as Clothing, Housing and Miscellaneous maintained a stable to marginally hardening trend.

Fuel Prices: The inflationary pressures emanating from fuel maintained its upward trajectory and touched 12.68% in

the month of Jun’21 as against 11.86% in the preceding month. There is a strong rise in demand for oil and gas in the US with people moving out and getting on to the highways for holiday destinations. This surge in demand may be restricted to the current season, but the general increase in demand due to the post-pandemic pick up in travel also is a noticeable feature affecting the prices. The US crude inventory has been coming down and it is at a multi-year low. The decline in the US crude oil inventories including the strategic petroleum reserves has been to the tune of almost 1 million barrels per day, and this trend is visible in the last three to four weeks consistently. These factors would add to the price pressures.

Core Inflation: The core inflation moderated marginally and after a gap of six months the core inflation was reported lower than the headline inflation. The core inflation came in at 6.16% for the month of June as compared to 6.40% seen in the preceding month. The Pan, Tobacco and Intoxicants inflation has been in double digits for a major part of the last one year, the current sharp easing has been one of the factors influencing the fall in core inflation. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 7.28% in the month of June as compared to 7.25% in the preceding month. Within Miscellaneous component, given the direct effect of rising fuel prices, Transport sub-component saw the sharpest rise in inflation at the rate of 11.56%. As the lockdowns are gradually withdrawn, the demand for various services is only going to improve leading to further price pressures.

Outlook: The inflationary pressures have been on the rise over the last few months, largely on the back of firm food

and fuel prices. As the inflationary pressures turned more broad based, the headline numbers stayed above the RBI’s

target range. RBI may overlook the latest inflation numbers in the immediate term as the focus at the current juncture is to support growth, the bank may have to reaffirm its stance as the bond yields have already started inching upwards. The benchmark 10yr g-sec yield has moved from 6.09% to 6.22% over the last one week. As an after effect of the stickiness seen in inflation numbers, market participants expect RBI to revise upwards its inflation projections. If these expectations come true, the bond yields may witness further pressure despite RBI maintaining an accommodative stance. Even as the economy is grappling with the adverse effects of the second wave and the activity level is yet to recover fully, the headline inflation numbers have already surged ahead. Having said that, the effect of rising demand may remain moderate this time around as compared to the last year, given the fact that the lockdowns were not as strict as the one seen during the first wave. The porous lockdowns have led to steady business activities and the economy may not witness any sharp surge of pent-up demand. Ongoing manufacturing leading to limited supply bottlenecks and a gradual rise in demand may put a cap on the rise in inflation.

At the current juncture, the key variable that would decide the near term to medium term trajectory of inflation numbers is the direction of global oil prices. The rising fuel price not only has a direct impact on headline numbers but seep into other components by way of second round effects, most prominently through transportation costs.