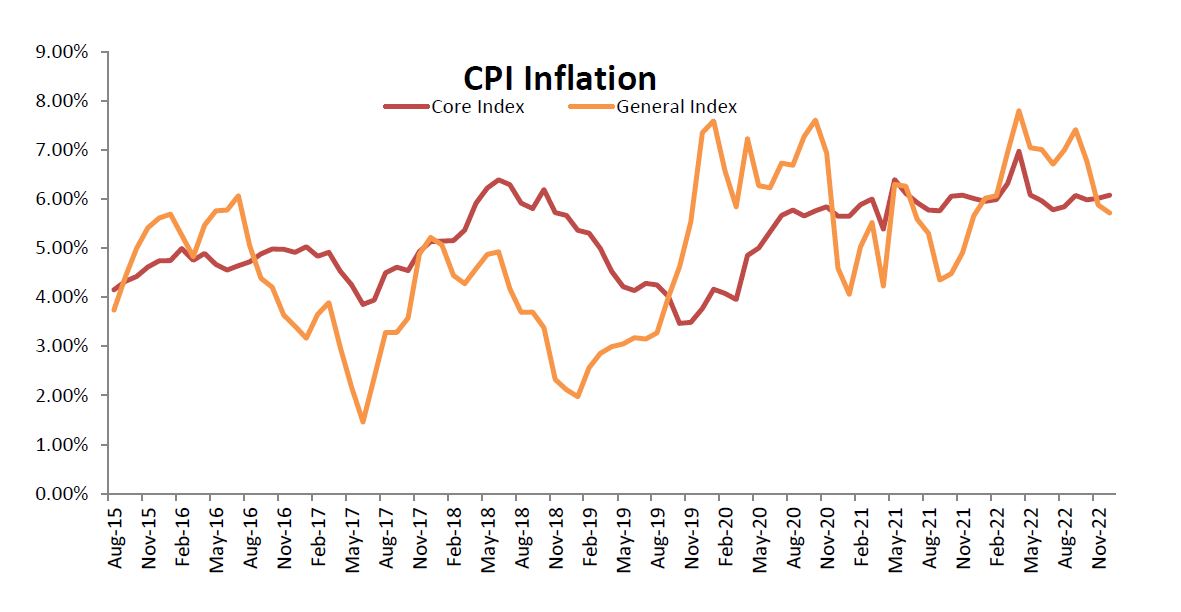

The CPI based inflation eased for the month of Dec’22 and was reported at 5.72%, a marginal surprise to the consensus estimates. This is the second consecutive month of headline numbers getting reported within the RBI’s target range; after remaining above the 6% mark for 10 consecutive months. The headline inflation number for the preceding month and for the year ago period was 5.88% and 5.66% respectively. The easing in inflation for food prices was the primary contributor to some respite seen in headline numbers. The core inflation though remained sticky at around 6% levels.

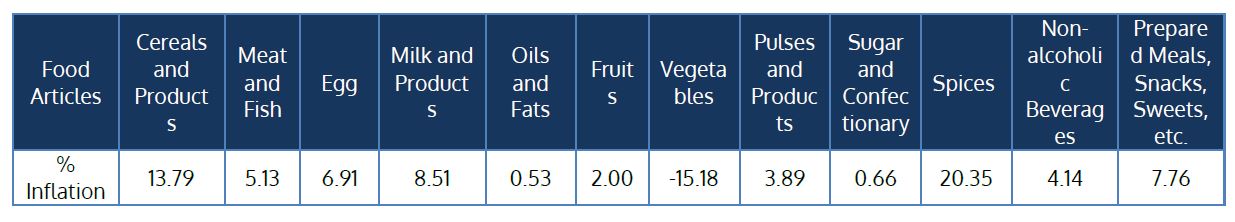

The Consumer Food Price (CFP) inflation eased on a YoY basis and also the underlying momentum, as measured by the MoM rise, has eased over the last two months. The CFP based inflation was reported at 4.19% for the month of Dec’22 as compared to 4.67% for the month of Nov’22. On a MoM basis, the food inflation eased by 1.64% for the month of Dec’22. Within the food basket, vegetables prices eased whereas cereals, egg and spices continued to witness inflationary pressures. The food inflation is expected to remain benign over the near term, owing to a good winter harvest. The inflation for Clothing, Fuel & Light, Housing and Miscellaneous was reported at 9.58%, 10.97%, 4.47% and 6.17% respectively.

Fuel Price

Oil prices have been pulled in different directions in the last three months. The coming into effect of the sanctions against Russia has been the singular important factor that could have affected oil prices. But prices at this juncture looks well supported at US$ 80-US$ 85 levels. It is quite possible that it could rise further. One of the factors that may contribute to this bullishness is the gradual opening up of China after the pandemic related restrictions. Russia has announced that they will cut the oil output in 2023. While this may not be of much consequence at the aggregate level it may have a sentimental impact.

The severe cold winds and snowstorms have crippled many refineries in the prime oil producing areas in the US, and it may take a fortnight before they could start normal functioning. This may have a temporary impact on output and prices. Overall, Brent seems to be stable at the current levels with more of upside risks.

Core Inflation

Even as the headline inflation eased for two consecutive months the Core CPI remained largely stable around the 6% mark. The core inflation (ex food and fuel) came in at 6.08% for the month of Dec’22. The stickiness in core inflation is reflective of the resilience of demand, especially in the services industry. The Clothing and Footwear continues to be sticky, close to double digits. The inflation emanating from the services industry is expected to be sticky and may even have an upward bias. The services industry bore a severe brunt over the last two years and is now witnessing strong resurgence in demand, and with it pricing power.

Outlook

The headline inflation numbers have eased and are now within the RBI’s target range; this has also led to real rates becoming positive. While the easing of inflation over the last two months would give RBI some comfort in terms of the trajectory being in line with its projections, it would do little to change the policy stance.

The easing of headline inflation has largely been a function of correction in food prices, one of the volatile and demand inelastic components along with fuel. The core inflation continues to be sticky and if the demand remains resilient the pricing power so attained may lead to further dearness in services industry. The risks of commodity led inflation transitioning to a services led one, may not allow RBI to lower its guard.

Keeping the stickiness of core inflation and the upside risks to commodities, given the opening up of Chinese economy, in context, the base case scenario is that RBI may effect one more rate hike in its upcoming policy meet and then take a pause. The easing in domestic headline inflation and similar movement in US inflation may provide the RBI necessary headroom to take a pause and gauge the impact of the rate hikes implemented till date.