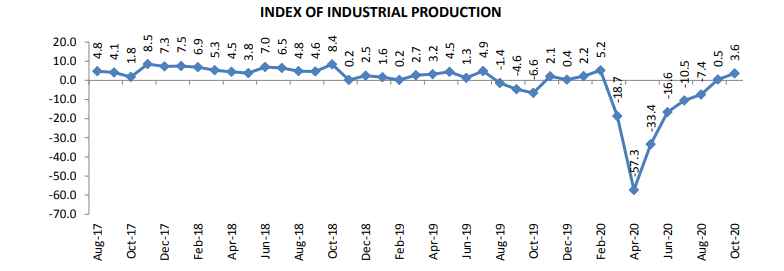

The IIP growth reverted to positive zone after a gap of six months in Sep’20 and maintained the momentum in the month of Oct’20. The IIP growth for the month of Oct’20 was reported at 3.6% as compared to upwardly revised growth of 0.5% in the preceding month and -6.6% in the year ago period. The support received from a low base during the year ago period and the sequential strength owing to lockdown relaxations coupled with the festive season were the key factors that supported the recovery in IIP. Though the market participants expected IIP growth to be positive but the final reading of expansion was higher than anticipated.

Out of the three constituent sectors of IIP, two, Electricity and Manufacturing, reported positive growth while Mining growth reported contraction. The manufacturing growth reported positive growth after contracting for seven consecutive months. The growth for manufacturing sector came in at 3.5% for the month of Oct ’20 as compared to -0.2% in the preceding month. From amongst the 23 industries forming part of the Manufacturing sector, electrical equipment, transport equipment and motor vehicles, trailers and semi-trailers were the industries to report the strongest growth rates. The growth for mining and electricity sectors was reported at -1.5% and 11.2% respectively for the month of Oct’20. The use-based classification numbers indicated that the growth numbers are turning broad based, with only one segment, out of the six classifications, reporting contraction. The Primary goods growth has now remained in contraction for eight consecutive months. The pent-up and festive season demand led to sharp improvement in growth rate of Consumer Durables (17.6%).

View:

The key lead indicators of growth have been indicating a gradually improving economic recovery. The effects of pent-up and festive season demand coupled with favourable base effect has played out in line with the street expectations. The real test of the sustainability of growth green shoots would be the demand seen post the festive season. As per the growth indications provided by the use-based classifications, the consumer demand has improved but the revival of capex cycle is yet to initiate. The growth is not yet on firm footing and would require ongoing support from both fiscal and monetary policy. In this regard, the government spending would be critical to support the overall GDP growth, especially when there are lingering fears of second wave of pandemic that may potentially derail the private consumption demand.