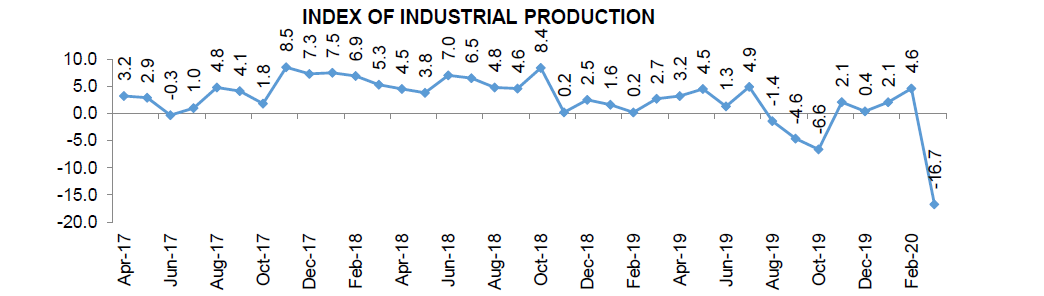

The IIP growth witnessed a sharp contraction of 16.7% for the month of March 2020, as compared to 4.6% in the preceding month and 2.7% recorded during the year ago period. While street estimates expected a contraction in IIP growth, the actual numbers were worse than expectations. The corona virus pandemic affected the production facilities, but the growth numbers have come as a surprise, as the month of March represented only a minor part of the lockdown period. Owing to the nationwide lockdown the data flow from producing units was impacted, the Quick Estimates are likely to undergo revisions. The IIP growth for FY20 was reported at -0.7%.

The growth for manufacturing sector, representing more than 77% of IIP, was reported at -20.6% for the month of March as compared to 3.1% in the preceding month, and 3.1% during the year ago period. All of the 23 industry groups forming part of the manufacturing sector reported negative growth rates for the month of March. The growth rates of the other two sectors, Mining and Electricity, remained lacklustre as well. The Mining sector activity remained non-existent as the growth rate was reported at 0% for Mar’20. The Electricity sector growth rate was reported at -6.8%. The growth rate for Mining, Manufacturing and Electricity sector for FY20 was reported at 1.7%, -1.3% and 1.1% respectively.

A similar trend was seen in use-based classification as well. The growth rate for all the segments of the use-based classification was reported in negative territory. The performance was weakest in Capital Goods and Consumer Goods categories. For the entire year of FY20 in case of use-based classifications was negative in case of Capital Goods, Infrastructure/Construction Goods and Consumer Durables, whereas expansion was reported for Primary Goods, Intermediate Goods and Consumer Non-durables.

View:

The IIP growth was expected to contract for the month of March, but the complete impact of the nationwide lockdown will be reflected in the index numbers for the month of April; as was indicated by the PMI numbers. The unprecedented situation of global pandemic and the resultant lockdown will have its impact on the production numbers; going ahead the focus would be on the road to normalisation, which may be a long drawn one. A smooth recovery would be dependent on the policy responses (both fiscal and monetary), that addresses both the spectrums of the economy, supply as well as demand. Both the segments of the economy may require sops to ensure limited impact and a gradual recovery. The IIP numbers may remain subdued over the medium term as demand is only expected to recover gradually. As has been the case over the recent past, government expenditure may have to do the heavy lifting in terms of expenditure to support the economy.

The immediate impact of the IIP numbers may be seen in the downward revision of GDP growth numbers of FY21, which may in turn negatively impact the earnings expectations of corporates.