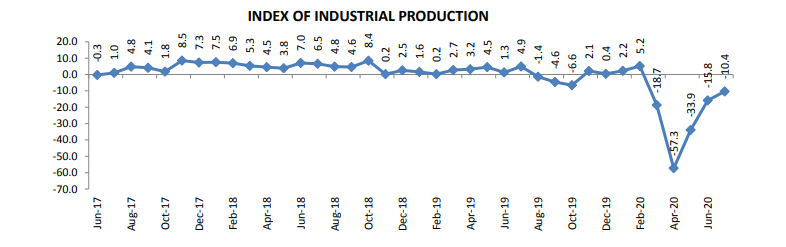

The IIP numbers continued to remain in contractionary zone and extended the streak to five months. The rate of

contraction is not as severe as seen during the months of April and May (months with strict nationwide lockdown), but the pace of recovery has lost some steam. The localised lockdowns and restrictions have led to lingering effect on

industrial production activity. The IIP contraction for the month of Jul’20 came in at 10.4% as compared to 15.8% in the preceding month. The IIP press releases of preceding months carried the caveat that these growth numbers may not be comparable to pre-pandemic data owing to lockdown led factory closures and data gathering difficulties. As the restrictions have been lifted, data availability has also improved. The IIP estimates for the month of July 2020 have been compiled with a weighted response rate of 87%.

The industrial activity is limping back to normalcy, with essential items demand and production being at the forefront of the revival. From amongst the 23 industries forming part of the Manufacturing sector, the growth for

pharmaceuticals, medicinal chemical and botanical products industry reported healthy growth rate of 22% for the

month of July. The second industry to make its way to positive growth terrain is tobacco products, registering growth

rate of 6.1%. The three key sectoral components Mining, Manufacturing and Electricity reported negative growth rates of 13%, 11.1% and 2.5% respectively for the month of Jul’20. The official press release continues to mention , “it may not be appropriate to compare the IIP for May 2020 with those of months preceding the COVID 2019 pandemic”. Thus, the official release indicates only the index numbers and has refrained from declaring the growth/contraction details.

Similar trend was witnessed in use-based classification as well, with pace of contraction slowing in the month of

May’20. The contraction in growth was the sharpest in Capital Goods and Consumer Non-durables, on the other hand contraction was slowest in Primary Goods and Consumer Durables.

View:

With localised lockdowns still in place and risk of second wave of the pandemic looming large, the road to recovery and subsequent growth maybe a long drawn one. The latest manufacturing PMI number gives some hope but at the current juncture it may be a function of pent-up demand rather than actual recovery. Apart from essentials, demand remains weak across industries. Even as the headline PMI numbers recovered, the press release indicated towards weakness in employment numbers. The issues concerning employment and thus income, may keep the IIP growth subdued.