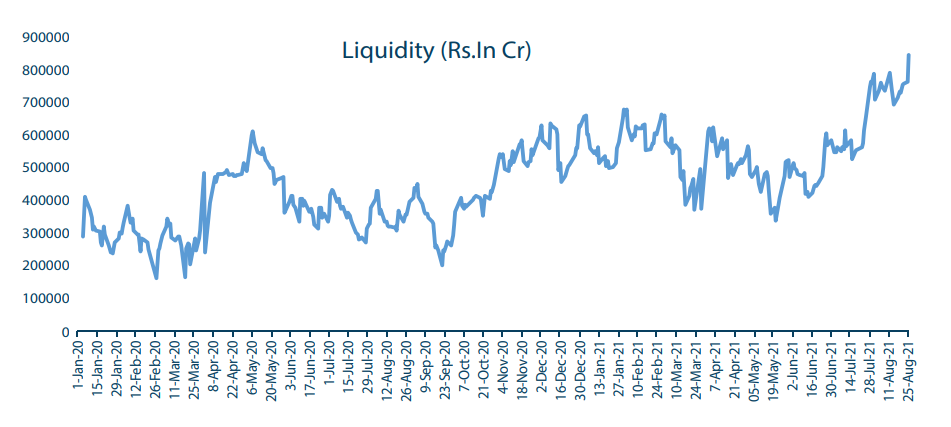

The domestic system wide liquidity is currently at Rs.8.50 Lakh Crs, and the interbank has a surplus of Rs.5.50 Lakh Crs on an average in the last three months. This is more or less the same amount that is tendered at the overnight fixed rate reverse repos. The liquidity overhang is demonstrated by the low overnight rates after the variable rate reverse repos. The weighted average call money rate has been hovering around 3.15% to 3.20 %, and the last variable rate reverse repo auction cut-off was at 3.41%, with the weighted average at 3.40 %. These numbers indicate a liquidity condition that remains in ample surplus, and which is unchanged for a long time now. This affords some comfort to fixed income investors that the prospects of any sudden spike in rates may not happen in the near future.

The retail inflation factor which was a very real threat to the low rates has moderated in the last two months. The August CPI is at 5.30 % as against 5.60 % in July. There are two readings now which are much lower than the RBI threshold of 6 %. There has been overall moderation in the price level. The potent threat from higher oil prices abroad and a weak Rupee still remains. With OPEC+ supply expansion from October the possibility of any flare up in oil prices can be ruled out. With better price level, the probability of any rate changes in the monetary policy review may be ruled out for this calendar year. But the growth-inflation dynamics could at any time take a different trajectory due to exogenous factors.

The government borrowing program has been completed to the tune of 55 % so far and the balance may be the carry forward to the second half year. There is a discussion centering around the borrowing program which focusses on the likely lower borrowings in the second half of the year. While it is possible the probability is low because the tax buoyancy which supports lower borrowings is not visible as of now. Yet another factor that is highlighted is the inclusion of gilts in some of the overseas indexes which may lead to large inflows into the domestic market which may soften the yields. However, as of today barely 35 % of the limits available for overseas investors has been utilized, and further, some of the domestic entities may consider it an opportunity to unwind the excess holdings of gilts. Therefore, the favourable impact on yields may be a bit overstated. The convertibility of the Rupee is one of the

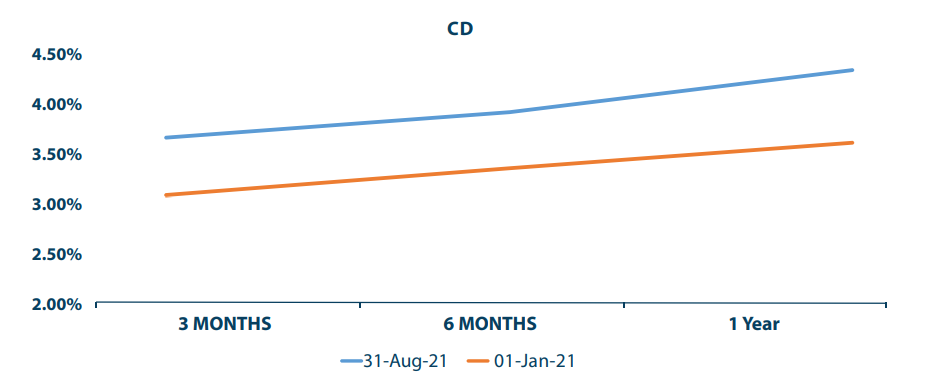

conditions which many foreign investors have been asking for to enhance their participation in domestic bond market. The last cut off at the treasury bill auctions have stayed at more or less close ranges, the 91 days at 3.29%, 182 days at 3.41 %, and the 364 days at 3.56 %. The short- term rates present a scenario of stable rates

At the long end of the curve, there was a spike in the ten- year yield to 6.25 % in the current ten year, the 6.10% GOI 2031. Subsequent to that the yields again moderated to 6.14 %, and currently it is trading close to 6.20 The yields have been responding to the US developments to a certain extent in the recent past. Despite the GSAP intervention to the tune of Rs.1.80 Lakh Crs, the pressure at the long end is likely to continue, and therefore, investor portfolios may be concentrated more at the short end of the curve. While liquidity is good and inflation is moderating, the action towards normalization may still be going to take place with sustainable growth setting in. Therefore, the need to be vigilant on portfolio positioning.