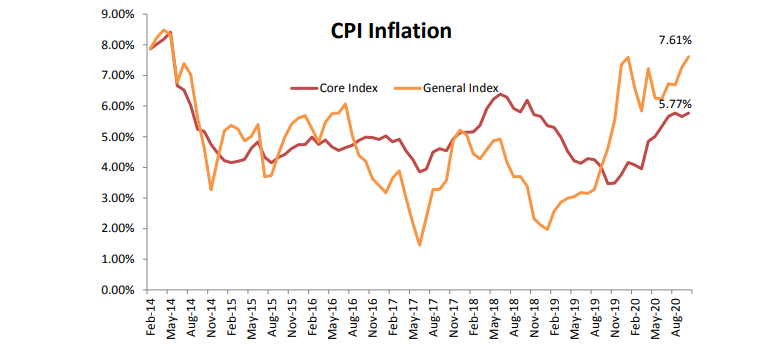

The CPI-based inflation maintained its upward momentum and surged further ahead; headline CPI inflation was reported at 7.61% for the month of Oct’20 as compared to 7.27% for the preceding month and 4.62% during the year ago period. The inflation numbers remained above the 7% mark for the second consecutive month. The elevated levels of food inflation during the year have been the major factor contributing to higher headline numbers. The inflationary pressures were marginally higher in rural centres as compared to urban centres. The CPI Rural inflation was reported at 7.69% as compared to 7.40% level for CPI Urban.

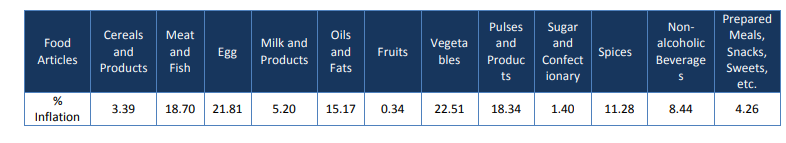

The continued firmness in food prices has been the major contributor to the upward surge in headline numbers. The

demand destruction had kept the inflationary pressures from other components under check, but as the lockdowns have been relaxed the price pressures are now visible in the other components as well. Except for fuel & light, most of the other components reported marginal uptick in price levels. The pan, tobacco and intoxicants has reported double digit inflation numbers for five consecutive months. The relaxations in lockdown lead to demand for housing returning in urban centres and resultant impact was seen in the inflation for this sub-head. Similarly, the effect of surge in demand for consumer durables was reflected in clothing and footwear. The components within food basket to report heightened inflationary pressures were Meat & Fish, Egg, Vegetables, Oils & Fats, Pulses and Spices. The price pressures, visible until now mostly in vegetables prices, have now picked-up in other members of the food basket as well.

Fuel Prices: This has been the only component to maintain its trend of easing inflationary pressures. The fuel-based

inflation eased to 2.28% for the month of Oct as compared to 2.80% in the preceding month. Oil prices are hovering

around the US$ 38-42 levels with an obvious downward bias, at present. This downward bias is the result of the rising COVID-19 infections throughout the US and the major countries of Europe. Except for China, the prospects of any rise in oil demand is more or less ruled out due to the prevailing sluggishness in demand which started with the spread pandemic.

Core Inflation: The core inflation remained largely stable for the month of Oct’20. The core inflation came in at 5.77% for the month of Oct as compared to 5.66% in the preceding month. The Pan, Tobacco and Intoxicants continued to report double digit inflation. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 6.88% in the month of Oct as compared to 6.89% in the preceding month. Within Miscellaneous component, heightened price pressures were seen in Transport & Communication and Personal care and Effects. While the essential services have reported inflationary pressures for past few months, the opening-up of the economy may lead to gradual price rises in other parts of the miscellaneous group, such as recreation & amusement.

Outlook: Food prices do not seem to be moderating contrary to earlier expectations, and from just fruits and vegetables the price surge has moved to all the major food components as well. This may have an impact on the trajectory of interest rates, and RBI may have to continue to focus on liquidity provision rather than rate action. It is also a fact that the economy is going through unprecedented economic developments and therefore one may expect a relatively higher price level. But persistently high inflation could invite action from the RBI by way of even reducing the free liquidity.