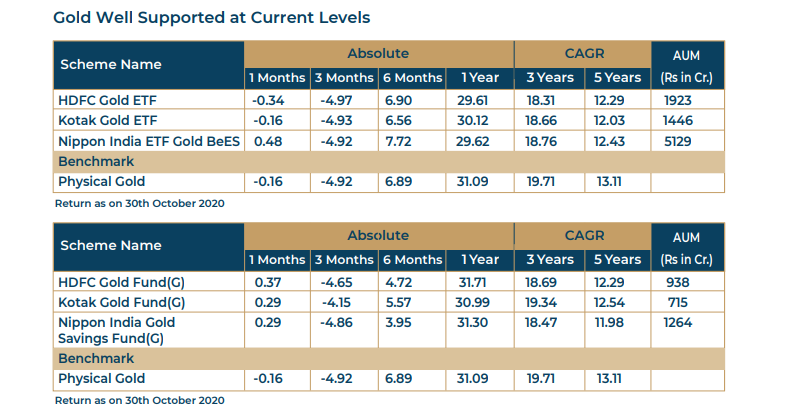

Gold is currently trading at US$ 1880, and the price movements have been with a downward bias in the last one month or so. This fatigue after a move above the US$ 2000 mark is attributed to a number of factors.

There has been selling by some central banks over the last two months. Central banks sold about 12 tons of gold in Q3. This is the first time since Q4 of 2010 that there were net sales by central banks. It may be that they may be wanting to book some profits in an asset class which otherwise does not yield anything by way of steady returns. The likely support levels for gold are at 1860, 1810 and 1750, in case of a price decline. In case of an uptick the potential is very much close to 1960/70.

There have been inflows into ETFs and for Q3 the ETF inflows was equivalent to 272 tons. This makes

the total size of gold ETFs 3,880 tons. The pace of ETF growth seems to have slowed down but there is

a net inflow.

The retail end of the market, like jewellery, has been affected by the spread of the pandemic and the lockdown. The Q3 demand for gold came down by 29%, Y-O-Y, to 333 tons. This was especially visible in large jewellery markets like India and China.

While gold looks well supported under the current circumstances there are certain factors that may have a disproportionately large influence on prices. Currently, the major factor that has triggered the rise in gold prices is the pandemic and the uncertainty in global economic growth. The fall in interest rates and the bond yields in major markets staying in the negative zone, non-availability of safe and lucrative alternate avenues for funds deployment are some of the factors that have resulted in gold strength. Therefore, one needs to bear in mind the fact that events like a major reduction in the fresh infections, the availability of an effective vaccine, rise in inflation and the resultant rise in interest rates, and a revival of global growth may contain the advance of gold beyond the levels seen so far. In other words, so long as the cloud of uncertainties envelops the global economies, gold may remain well supported.