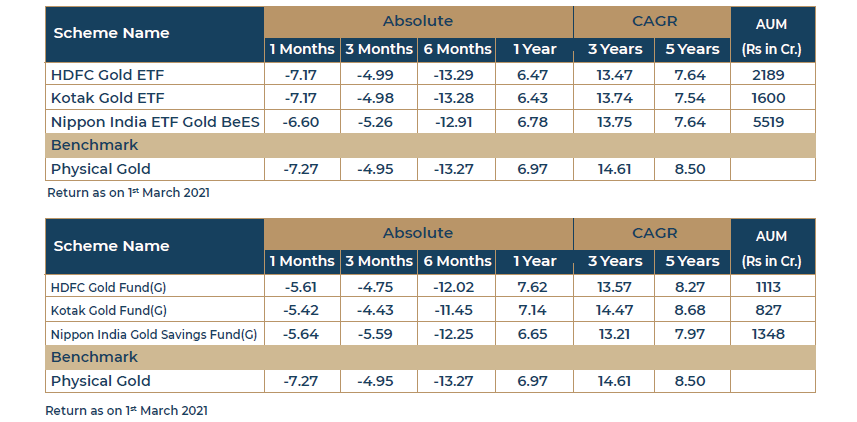

Gold prices moved up from mid-2019 onwards to 2020 end, mainly due to two or three crucial factors. Broadly the range was from 1430 to 2067. The first and most important, fundamental, cause was purchases by central banks and the large inflows into gold exchange traded funds. The lower interest rates in many of the developed countries including the US also helped a surge in gold prices. But the more potent reason for the gold to move up was the uncertainty created by the pandemic and the financial distress generated by the event. The demand destruction, the loss of jobs, and the fall in demand and output all came together to intensify the magnitude of the economic impact, which the pandemic had on the global economy. This led to demand for gold as a measure of moving into safe haven, and so the prices moved up.

With the development of vaccines and the rebound in the economies across the world, the uncertainty created by the pandemic has been arrested significantly, and therefore, gold prices started declining. Currently, gold is trading at around 1690 levels, and it is expected to test lower levels in the coming months. The rise in gold prices started from the 1430/ 1480 levels, and any break of 1630 could take the gold prices to still lower levels technically.

There are no central bank purchases of a critical quantity which can fuel the prices again at this juncture. In addition to this, interest rates are set to rise gradually. The bond yields in many of the developed markets have started rising, and the US 10 Year treasury yield is at 1.50 % already. This rise in bond yields reflect to a large extent the higher inflationary expectations, and also the likelihood of gradual normalization of the liquidity conditions as economic recovery is under way.

But we should not rule out better support for gold over a period time mainly on account of the high inflation scenario that is likely to emerge in the global economies which are witnessing sharp eco nomic rebound. The function of gold as a hedge against inflation may get triggered in the face of persistently high inflation. But such a scenario still lies mostly in the realm of speculation.