The domestic equity markets have been hovering around the peaks, which the indexes have formed in the last couple of months. The domestic macro numbers have been on expected lines, and it gave comfort to the markets about the sustainability of the rebound in economic activity. But it is mostly the events from overseas markets which have been having an impact on the domestic market movements. In this connection, it is particularly worth mentioning that the developments in the US market have been a major factor in deciding the course in recent times

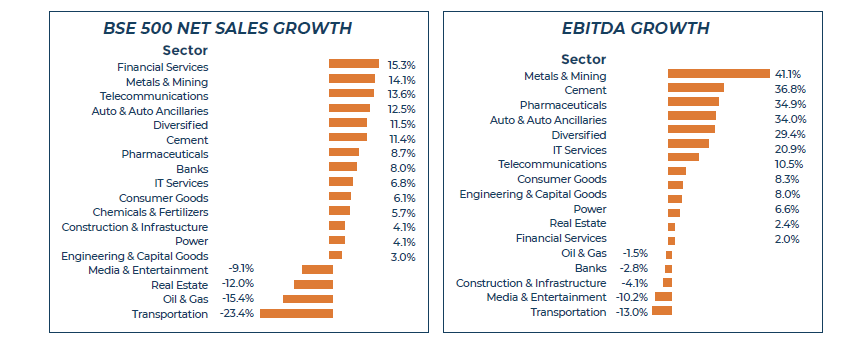

The US bond yields have moved up quite sharply, the ten-year treasury has touched 1.60%, and this movement is occasioned by the expectations of a higher price level in the US. As economic recovery is happening at a swift pace, faster than expected, it is highly likely that some amount of inflation would also crop up. This has been confirmed by the Fed Chairman. But he also hinted that the rise in inflation would be transient. But the market believes that the moment price level rises Fed would start modifying the policy stance though gradually. This is causing the current surge in yields. The question is whether there is going to be inflationary pressures in the domestic economy too? Domestic inflationary pressures may rise if the fuel prices continue to go up. Brent is going up and it is expected to go higher, and this may have an adverse impact on the economy as India is a major importer of oil. The Q2 corporate performance was good on account of operational efficiencies whereas Q3 further reaffirmed the improving corporate earnings. In line with the preceding quarter, EBITDA margins showed further improvement. The top line growth too reported healthy numbers, indicating an improvement in demand conditions. Most of the Nifty companies beat analyst earning estimates and after a fairly long gap corporates may witness a round of earnings upgrades, thereby partly allaying the concerns with respect to rich valuations. The high commodity prices and the galloping oil prices may have a negative impact on some sectors of the economy. This may be aggravated if there is rise in yields and consequently if the borrowing costs go up. These are factors to be considered while taking a look at the markets.

Read More in our latest issue of Navigator