The equity indexes have been quite buoyant over the recent past with some money from overseas investors tricking in. While this provides a positive anchor to the markets, the future will depend on two critical factors. The first is, one needs to see the inflationary pressures gradually coming down and the same brining in moderation in central bank policies. Here the relevant central banks for the markets would be the RBI and the Fed. The hawkishness of the Fed and its determination to continue to take rate action remains a factor that needs to be watched for more time. The general belief is that inflation may have peaked and the Fed might reduce the pace and quantum of rate hikes. The RBI in its latest monetary policy has moderated the pace of rate hikes, and the same stance is expected from other global central banks against the background of likely slowdown in growth.

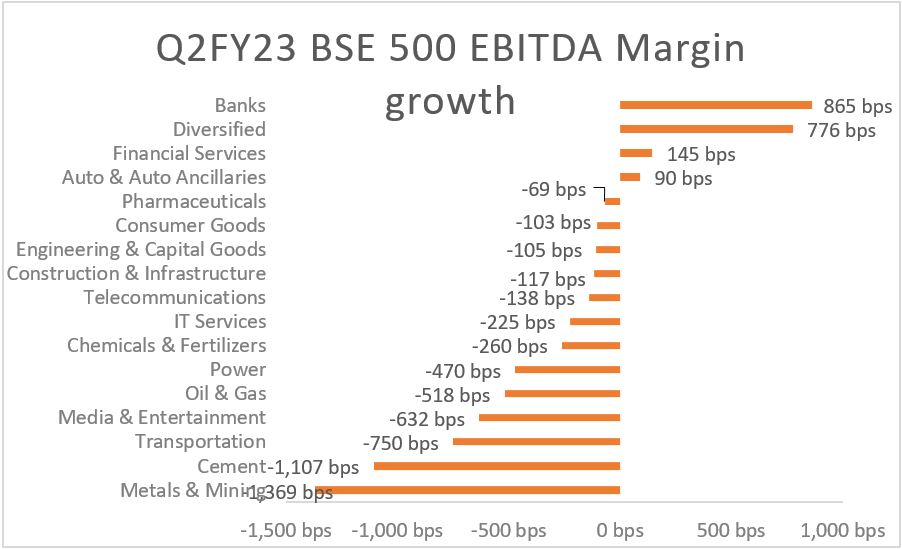

This may be positive for the markets. The shut down in the Chinese provinces in response to zero covid policies, and the selective re-opening, and the likely side effects of he rate hikes in major economies in the form of decline in economic growth is a are also concerns for the markets. This may also prompt a relatively softer approach to rate hikes in the coming months. But policy action is not yet over and it may continue to another three months at least. The stability in the currency is of paramount concern for overseas investors. While the Rupee has firmed up a bit from the lowest levels it touched, the currency is yet to stabilize and this is a pre-requisite for any meaningful inflows into the markets. The earnings season has been a mixed bag and the forecasts of a robust economic growth will support stable earnings in domestic businesses. Apart from a robust demand witnessed in the recent past the cascading impact of the governmental initiatives like the production linked incentives is likely to provide a boost to the overall business and industry through its positive impact on income growth.

The relatively higher growth when compared to other larger economies like the US and China and the Euro Region, could highlight the local market as an area of growth. The market yields are on a rising trend and the same may accelerate with a scramble for funds as we move to the last quarter of the year. This may push up the cost of funds for corporates though the reliance on borrowed funds by companies in the mid cap segment shows a falling trend. But the positive signs from these developments is that the growth in credit which is close to 17 %, is the highest levels that are seen after a period of almost five years. This indicates the level of overall economic activity and it is an encouraging development. It is a fact that the local markets mirror the US markets to a large extent and this cannot be ruled out in the coming days too. Therefore, while we enjoy the stability from relatively stronger fundamentals, corrective downward movements in alignment with overseas events and developments may not be ruled out. The approach to investing in a graduated fashion may be adhered to and some sectors which have seen significant correction may make investment sense for the long term portfolio.