The economic cycle follows a pattern of boom and bust; every boom period lays the foundation of down cycle and vice versa. A look at the economic history indicates that every single time the trigger points of a down trend have been fairly diverse, whether it be tech bubble, excesses or leverage of the financial markets or the most recent one – a pandemic. This makes the predicting or timing of economic cycles a potentially hazardous endeavour. The investors, thus, should maintain focus on actionable that can hold stead over longer investment horizons.

With the above perspective, the key areas are, (i) investment discipline and (ii) quality of investments. In the current scenario, thus it is advised to maintain a bias in favour of large cap companies. These are the companies which have emerged stronger from each economic cycle and are expected to survive these phases in the future as well.

Emerging Stars

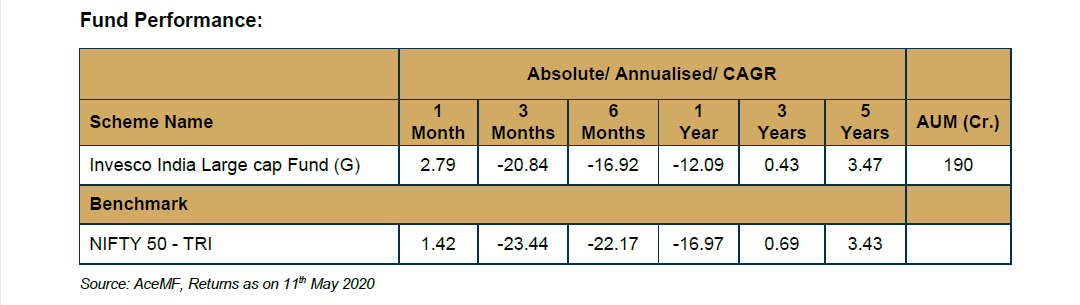

In the category Emerging Stars, we highlight funds that are expected to climb-up the ladder of performance, and likely to move up in rank in our selection model – EnEf model. The confidence of improved over-all performance in the various tests presented by the EnEf model largely emanates from the recent absolute returns comparison and the uptick seen in the scheme ranking. These funds hold the potential to enter the top quartile of EnEf rankings. In the current issue of Emerging Stars, the scheme in focus is Invesco India Large Cap Fund.

Invesco India Large Cap Fund

Investment Objective: To generate capital appreciation by investing predominantly in Large Cap companies.

Fund Manager: Mr. Amit Ganatra and Mr. Nitin Gosar

Inception Date: August 2009

Fund Manager Speak: Mr. Nitin Gosar

Global economy is undergoing through health and economic crisis, and India is no different. Today we stare at two possible outcomes a) swift improvement in economic environment or b) economic environment continues to remain tough. In an uncertain economic environment, companies with strong balance sheet and execution track record are more resilient and agile enough to return to growth once economic conditions start to improve. They have the ability to navigate the current crisis and emerge winners. The current market correction provides an opportunity to participate in such companies, which otherwise are difficult to comprehend on valuation.

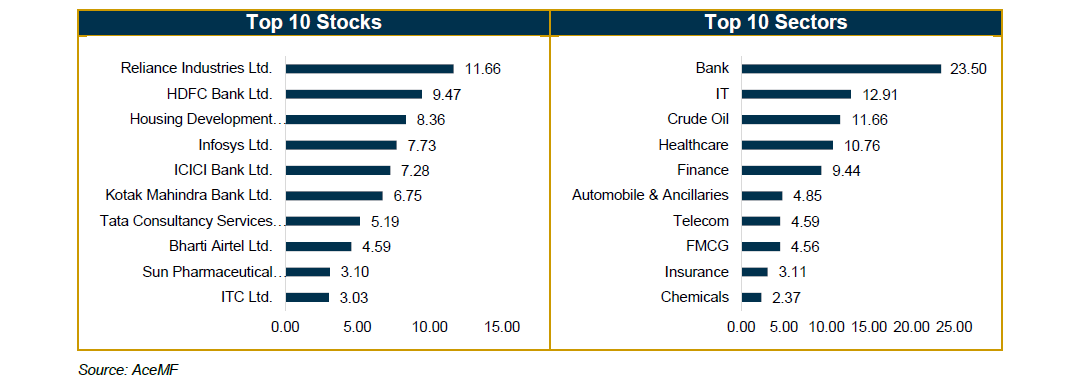

Invesco India Large Cap fund’s emphasis is on bottom-up approach towards companies with an overlay of optimum balance between defensive and pro-cyclical, allowing investors to effectively participate in this evolving situation. The fund’s approach is sector agnostic and invests in companies with strong execution track record and ability to grow at compounding rate. In financials, the fund has invested in companies with the ability to absorb higher NPA and still grow, within healthcare the fund has exposure to leaders in the domestic and international market, and in consumer staple the fund has presence in staples as well as evolving categories.

Investment Strategy:

• Preference for companies which are leaders within the sector or segment

• Companies with high market share and stable cash flows

• Globally competitive enterprises

• Companies with Limited requirement for large capital expenditure in the near term

• Ability to invest in new-age business, high free cash flows generation

Portfolio Composition: