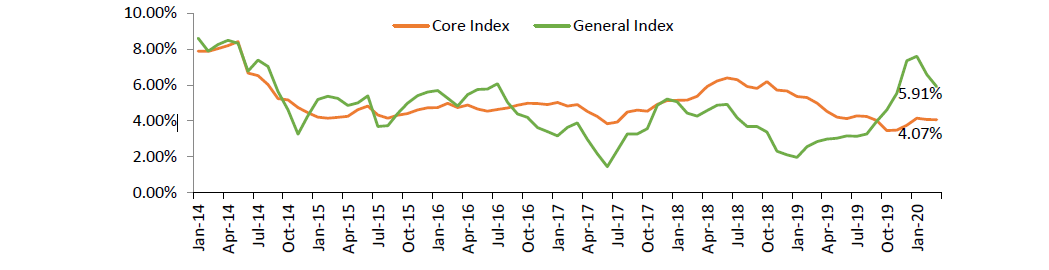

The CPI based inflation numbers eased for the second consecutive month; after touching a high of 7.59% in the month of Jan’20, the headline inflation number for the month of Mar’20 came in at 5.91%. The core inflation numbers too maintained an easing trend. The latest inflation numbers are an estimation, as data collection efforts were suspended with effect from 19th Mar’20; till this date price quotations of 66% of the items had been collated.

The seasonality headwinds for food articles have been ebbing since the last three months and that led to softening of Consumer Food Price Index based inflation. The CFP inflation for the month of Mar’20 was reported at 8.76% as compared to 10.81% in the preceding month. The CFP inflation touched the current series high of 14.19% in the month of Dec’19. Vegetables, Pulses and Spices continue to be the major contributors to food inflation, but the pace of growth has eased considerably as compared to previous months.

The inflation rates for most of the other components of CPI remained largely stable in the month of Mar’20. The inflation in Pan & Intoxicants prices was reported at 4.71%. The inflation emanating from Housing segment was reported at 4.23%. The inflation in Fuel and Light Index hardened marginally to 6.59%, as compared to 6.36% in the preceding month; the inflationary pressures are expected to remain muted from this segment going ahead on the back of low oil prices. The inflation for Miscellaneous component was reported at 4.43%.

The Core inflation maintained its gradual downward trajectory and was reported at 4.43% in Mar’20 as compared to 4.51% in the preceding month. The country wide lockdown and the resultant demand destruction is expected to keep the core inflation at bay.

Our View:

The CPI based inflation number was reported within the RBI’s target range for the first time in 4 months. This should provide some relief to the central bank in terms of providing it some space to maintain the focus on supporting growth and facilitating swift transmission. The economic impact of COVID 19 is being felt globally; the fiscal and monetary authorities are working in close coordination to minimise the damage to their respective economies

From a near term perspective, the inflationary pressures are expected to remain in control as lockdown situation will keep demand side pressures at bay. Apart from essentials, the demand for all the other goods and services may remain virtually non-existent, and thus, may not see any price escalations. Currently, the food basket remains the only component that can potentially see some upside. From a medium-term perspective, the inflation trajectory would be dependent on supply side management. As the situation normalises over time and regions come out of lockdown, the supply side machinery needs to maintained in well-oiled condition to meet any surprises from pent-up demand.