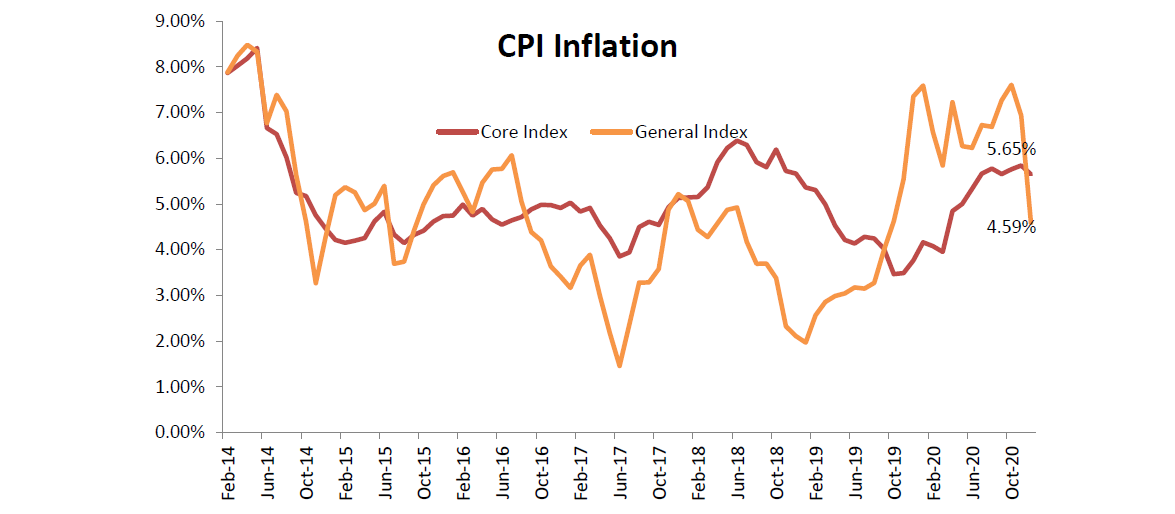

The CPI based inflation eased for the second consecutive month on the back of fall in prices of food articles; headline CPI inflation was reported at 4.59% for the month of Dec’20 as compared to 6.93% for the preceding month and 7.35% during the year ago period. The headline inflation numbers touched a fifteen-month low and was reported within the MPC’s target range after a gap of eight months. The surge in food inflation had been the biggest contributor to the hardening trend seen in CPI inflation in CY2020 and the long expected fall in this component has brought about some relief.

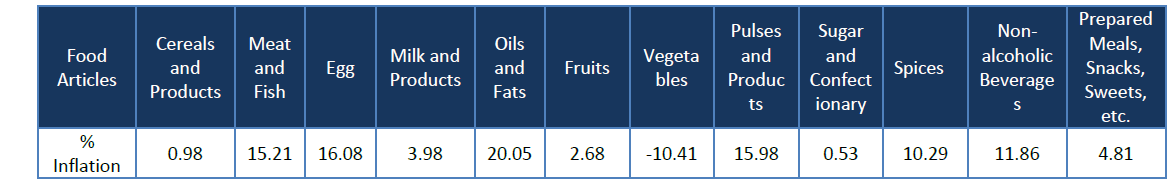

The Consumer Food Price (CFP) inflation had remained at elevated levels for more than a year. The food inflation was continuously reported in low double digits or high single digits, as the pandemic driven lockdown led to high demand and the inclement weather impacted supply. The normalization of weather conditions and the easing logistical hurdles due to withdrawal of stringent lockdowns improved supply of essentials. The CFP inflation came in at 3.41% for the month of Dec’20 as compared to 9.50% in the preceding month. Apart from food inflation, the inflation numbers for other components remained largely stable as compared to preceding month levels. The prices of pan, tobacco and intoxicants component maintained an upward trend and reported double digit inflation. The sub-components within the food basket to report easing were vegetables, cereals, and pulses.

Fuel Prices: The inflationary pressures emanating from the fuel components picked-up pace in the month of Dec’21. The fuel-based inflation was reported at 2.99% for the month of Dec as compared to 1.62% in the preceding month. Oil prices continue to stay above the US$ 50 level, and it seems to be wanting to base itself at these levels for a potential upward movement. The US Dollar has been weakening against all the currency majors, and usually a weak Dollar triggers a rise in oil prices. This is due to the fact that oil is quoted in US Dollars in the international markets. In the earlier stretches of US Dollar depreciation also the same trend was witnessed.

Core Inflation: As against the sharp easing in headline inflation, the core inflation remained largely stable. The core inflation came in at 5.65% for the month of Dec as compared to 5.84% in the preceding month. The Pan, Tobacco and Intoxicants continued to report double digit inflation. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 6.60% in the month of Dec as compared to 7.01% in the preceding month. Within Miscellaneous component, heightened price pressures were seen in Recreation & Amusement, Health and Personal care & Effects. The opening-up of the economy will gradually impact the inflation on miscellaneous component the most. The inflation for clothing and footwear component moved up to 3.49% in the month of Dec’20 as compared to 3.36% in the preceding month.

Outlook: The fall in CPI based inflation within the MPC’s target range would come as a much-needed respite. The RBI had been maintaining an accommodative stance even as the inflation numbers were continuously running outside its targeted range. The monetary policy was growth supportive and accommodative, but the mounting inflationary pressures had given rise to speculations with regard to the time period the central bank would be able to do so. The food prices took longer than expected to ease; going ahead the food prices are expected to remain subdued and not create upside pressures for headline numbers. The major risk to CPI would be from core components and fuel. The reopening of economy would be a booster for the service industry and the improving demand can influence the other components as well. The administration of COVID vaccine at the global scale is expected to be positive for fuel prices.

If food inflation maintains its current trend, the risks to CPI based inflation appear to be balanced at the current juncture. The inflation remaining in the targeted range would provide RBI the flexibility to remain accommodative for longer time and also normalize the surplus liquidity scenario in a phased manner, and not be market disruptive.