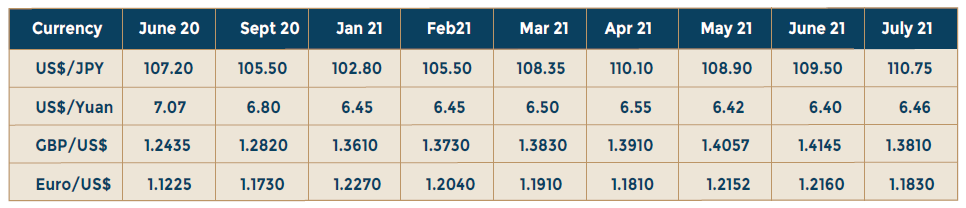

The US Dollar has been strengthening over the last two months and the main reason behind this strength is the performance of the US economy. After the pandemic, the recovery of the US economy has been faster that expected. This invested the economy with two extremely fast paced variables, a high rate of economic growth, and a rising consumer price index. While inflation feeds on growth, persistent inflation puts brakes on the acceleration of growth. The rise in prices is certainly a catalyst for fundamental policy changes by the Fed. Rates are likely to rise and the liquidity which the Fed has been injecting into the system to combat the pandemic driven sluggishness is likely to be withdrawn gradually. This expectation has supplied immense amount of wind in the dollar’s sails. When interest

rates rise currency yields too will rise. Lot of short- term liquidity chases currency yields. This enhances the asset demand for US Dollars. To the extent money moves into the US there could be some outflows from emerging markets and therefore, some of the emerging market currencies may depreciate against the dollar. Apart from this, whenever there is liquidity expansion by central banks, quite a bit of this money moves into emerging markets chasing the high-risk yields, and whenever conditions normalize, and the liquidity starts getting withdrawn these funds too would liquidate positions and move out. However, long term funds like pension funds and many sovereign funds continue to stay invested. There is recovery in Europe and the Euro and the Pound Sterling may hold well against the dollar relative to other currencies.