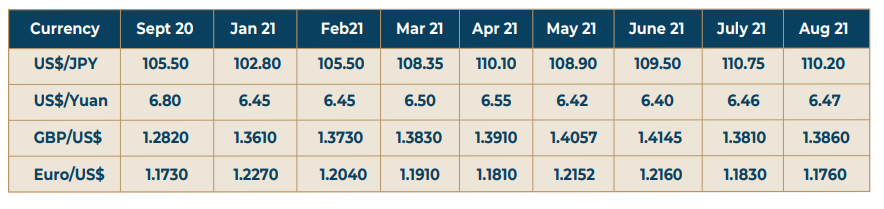

The latest jobs report presents a stronger US economy, and the number of jobs added is 943,000 as against the market expectations of 870,000. This has lent good amount of support to the Dollar as the Fed had indicated earlier that it would be monitoring the improvements in the job market for possible direction to the money policy. The Dolar Index has moved up too. The probability of an earlier than expected rate action from the Fed is what is energizing the bids for US Dollar. The Pound Sterling drifted down in the past few days mainly due to the strength of the US Dollar. But there is another story that has been taking shape in the UK politics and it concerns the UK Pime

Minister and the Chancellor. The PM is contemplating a demotion of the Chancellor to Health Minister, and the Chancellor saying that he would occupy the back benches rather than take a demotion. The PM has been warned by many that any such move would lead him to a challenge to his leadership very soon. This is still a developing story, and this story led to a slump in the Pound Sterling exchange rate The Euro too fell below the 1760 level after US jobs data, and also on account of a rise in US rates earlier than expected. The critical support levels for the Euro are 1750, 1700 and 1600. A test of the 1600 levels seen in last Nov.20 cannot be ruled out despite the ECB posture that any rise in inflation on a sustainable basis would call for action from the central bank. But the data has not been wholly

supportive of this thesis so far. The IHS Markit Eurozone Construction Purchase Manager Index (PMI)

was at 49.80 in July lower from 50.30 in June. There have been lockdowns in Europe and the vaccination program in Europe has not been a success as yet contrary to expectations. The fear of another wave is also gripping some parts of Europe. In comparison to this it is argued that the US is much better placed for sustained economic expansion.

Chinese economic activity is sluggish. The manufacturing PMI registered the slowest growth in the last one and a half years. The PBOC has reaffirmed its commitment to an easy money policy, as the number of covid cases is rising gradually, and there is a fear that it may proliferate itself unless contained aggressively